1.3 — Comparative Advantage

ECON 324 • International Trade • Fall 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/tradeF20

tradeF20.classes.ryansafner.com

The Origins of Exchange I

Why do we trade?

Resources are in the wrong place!

People have better uses of resources than they are currently being used!

The Origins of Exchange II

Why are resources in the wrong place?

We have the same stuff but different preferences

The Origins of Exchange III

Why are resources in the wrong place?

We have different stuff and/or different preferences

Transaction Costs and Exchange I

- But Transaction costs!

- Search costs: cost of finding trading partners

- Bargaining costs: cost of reaching an agreement

- Enforcement costs: trust between parties, cost of upholding agreement, dealing with unforeseen contingencies, punishing defection, using police and courts

Transaction Costs and Exchange II

With high transaction costs, resources cannot be traded

Resources cannot be switched to higher-valued uses

If others value goods higher than their current owners, resources are inefficiently allocated!

Transaction Costs and Exchange III

Markets are institutions that facilitate voluntary impersonal exchange and reduce transaction costs

There's a lot of institutions in the "bundle" we call "markets":

- Prices, profits and losses, property rights, rule of law, contract enforcement, dispute resolution, protection, trust

Transaction Costs and Exchange III

All of those things are assumed when we draw nice supply & demand graphs on the blackboard

How do various political institutions enable these market institutions to succeed?

Comparative Advantage

Specialization

Adam Smith

1723-1790

"It is the maxim of every prudent master of a family, never to attempt to make at home what it will cost him more to make than to buy...If a foreign country can supply us with a commodity cheaper than we ourselves can make it, better buy it of them with some part of the produce of our own industry, employed in a way in which we have some advantage." (Book I, Chapter 2).

Smith, Adam, 1776, An Enquiry into the Nature and Causes of the Wealth of Nations

Specialization in the Presence of Absolute Advantage

Martha Stewart is a world renowned decorator and designer

She also claims to be able to iron a shirt better and faster than anyone else

Should she iron her own shirts?

“I don’t always do all of my own ironing, even though I wish that I could.”

Specialization in the Presence of Absolute Advantage

Even in the presence of absolute advantage (one party is more efficient at producing all goods), it still often is better for them to specialize

- A high opportunity cost of producing everything

Pay others to perform a task, or purchase a good, and specialize in producing goods where you have the lowest opportunity cost

This is the principle of comparative advantage

Comparative Advantage

Paul Samuelson

1915-2009

Economics Nobel 1970

Sanislaw Ulam once challenged Samuelson to “name me one proposition in all of social sciences which is both true and non-trivial”

Samuelson’s answer: comparative advantage

“That it is logically true need not be argued before a mathematician; that is is not trivial is attested by the thousands of important and intelligent men who have never been able to grasp the doctrine for themselves or to believe it after it was explained to them,”

Ricardian Comparative Advantage

David Ricardo

1772-1823

“To produce the wine in Portugal, might require only the labour of 80 men for one year, and to produce the cloth in the same country, might require the labour of 90 men for the same time. It would therefore be advantageous for her to export wine in exchange for cloth. This exchange might even take place, notwithstanding that the commodity imported by Portugal could be produced there with less labour than in England. Though she could make the cloth with the labour of 90 men, she would import it from a country where it required the labour of 100 men to produce it, because it would be advantageous to her rather to employ her capital in the production of wine, for which she would obtain more cloth from England, than she could produce by diverting a portion of her capital from the cultivation of vines to the manufacture of cloth.”

Ricardo, David, 1817, Principles of Political Economy and Taxation

Ricardian Comparative Advantage

David Ricardo

1772-1823

Sought to explain an apparent paradox: countries often produce & export goods they don’t seem to be “good at producing!”

Answer: citizens of the importing country are even better at producing something else (in relative terms)

- Worthwhile for the exporting country to buy this from abroad (with exports as payment)

Ricardo, David, 1817, Principles of Political Economy and Taxation

A Simple Example of Comparative Advantage

A Simple Example of Comparative Advantage

Start with the simplest model of exchange

A single person (Robinson Crusoe) marooned on a deserted island

Autarky: complete self-sufficiency (no exchange)

- Must produce everything one consumes

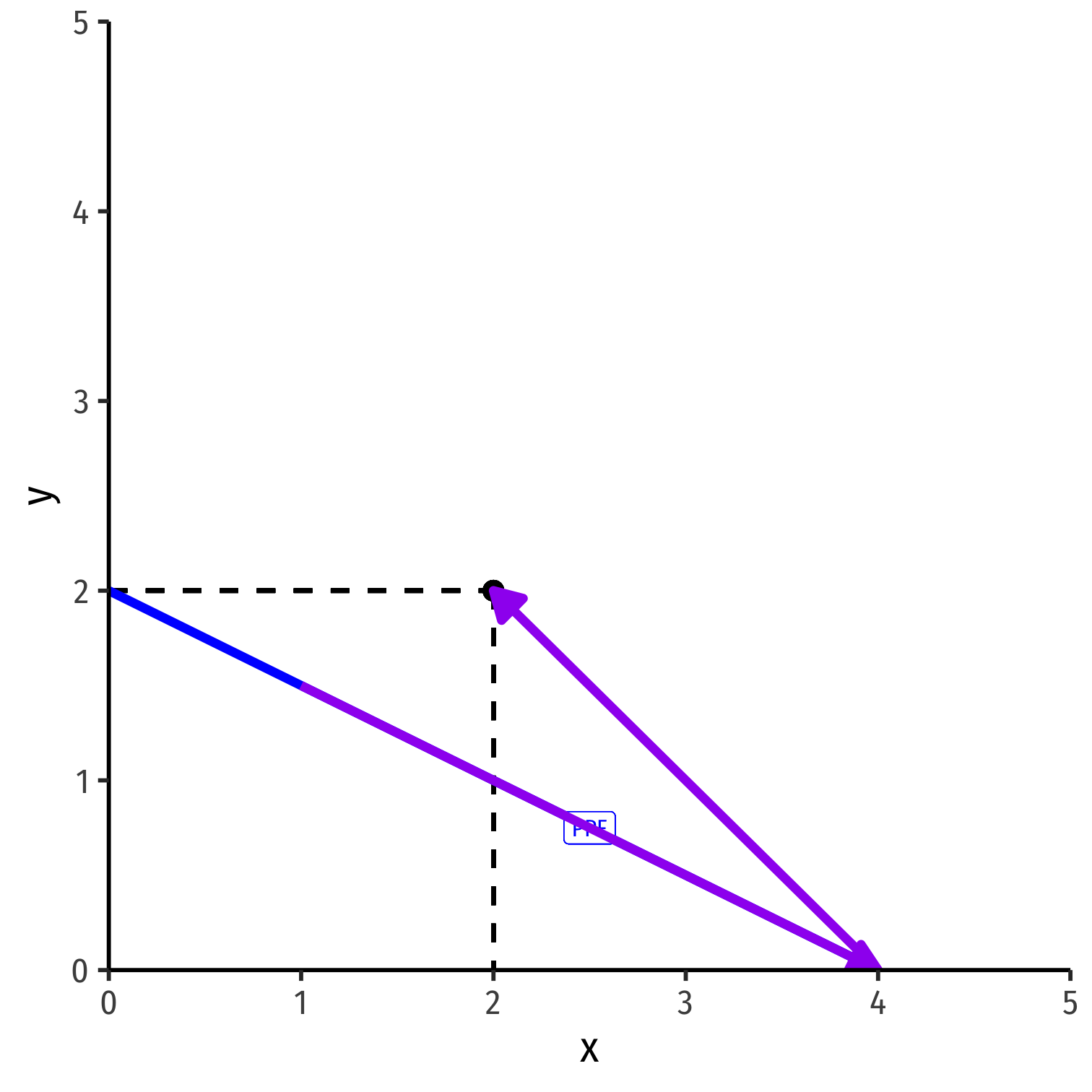

A Simple Example of Comparative Advantage

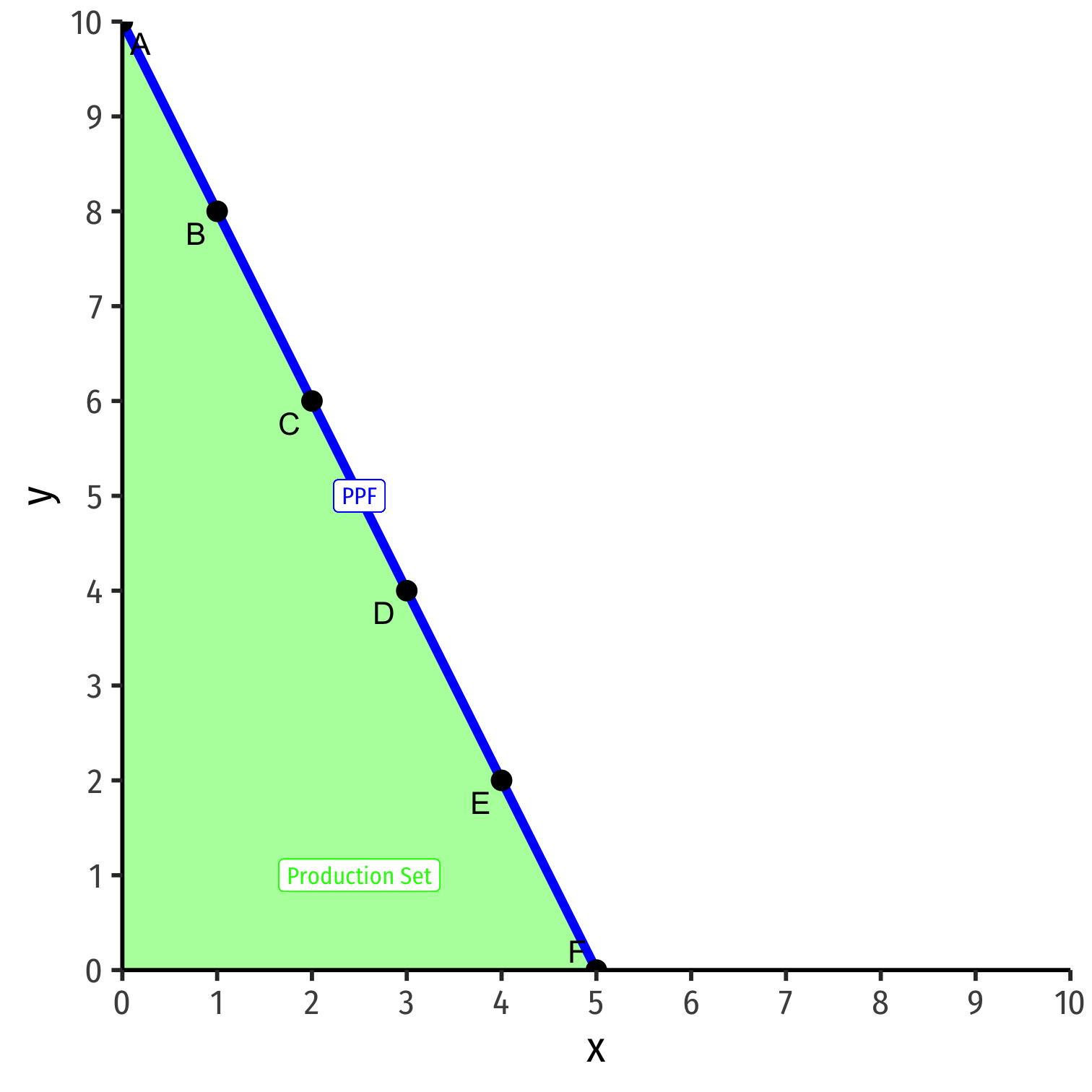

Crusoe’s production set represents the set of all possible production opportunities

Production possibilities frontier (PPF) represents the subset of production opportunities that use all available resources

- i.e. Crusoe uses all his available time to produce a combination on his PPF

A Simple Example of Comparative Advantage

- Points on the frontier are efficient (uses all available labor supply)

- Points A-F

A Simple Example of Comparative Advantage

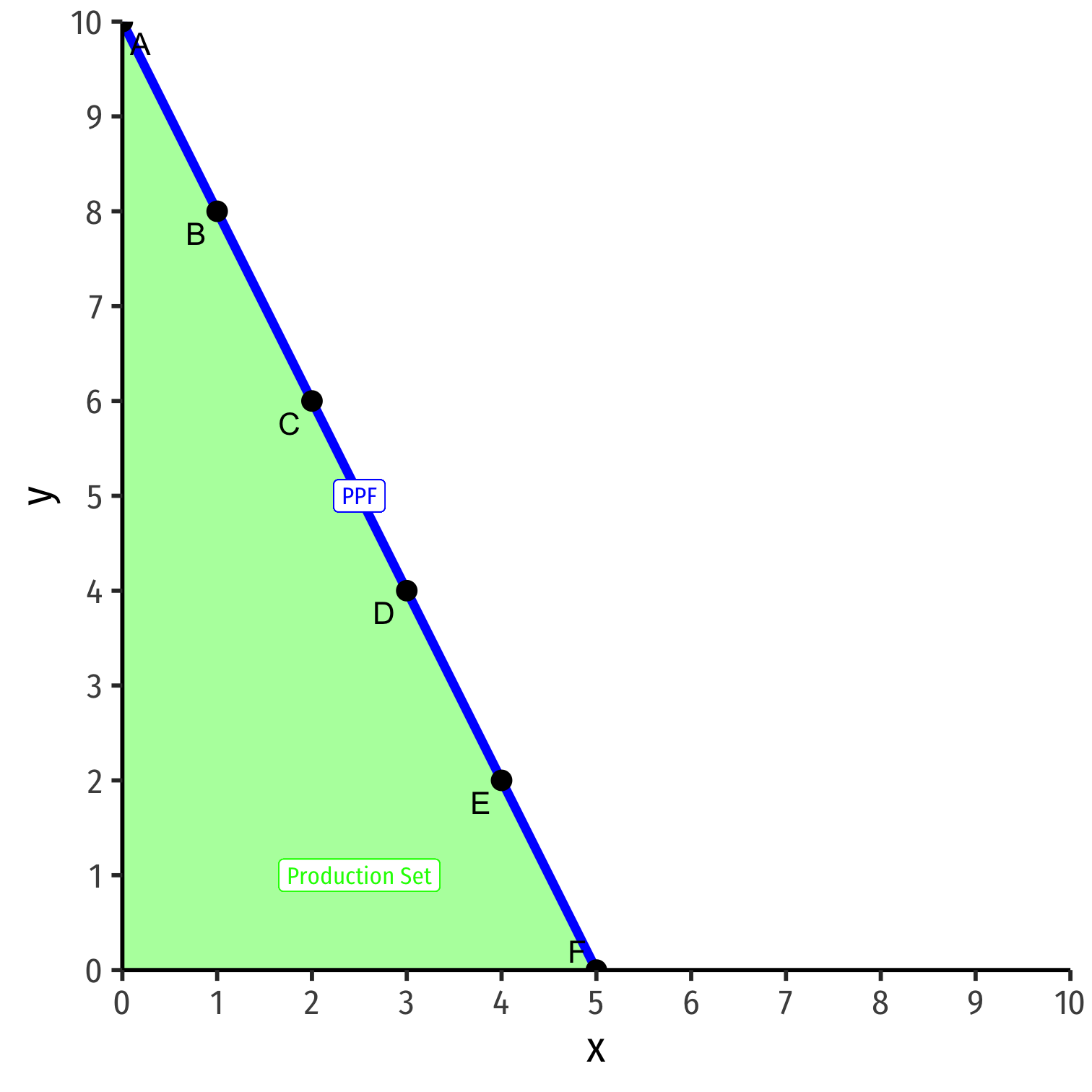

Points on the frontier are efficient (uses all available labor supply)

- Points A-F

Points beneath the frontier are feasible (in production set) but inefficient (does not use all available labor supply)

- Point G

A Simple Example of Comparative Advantage

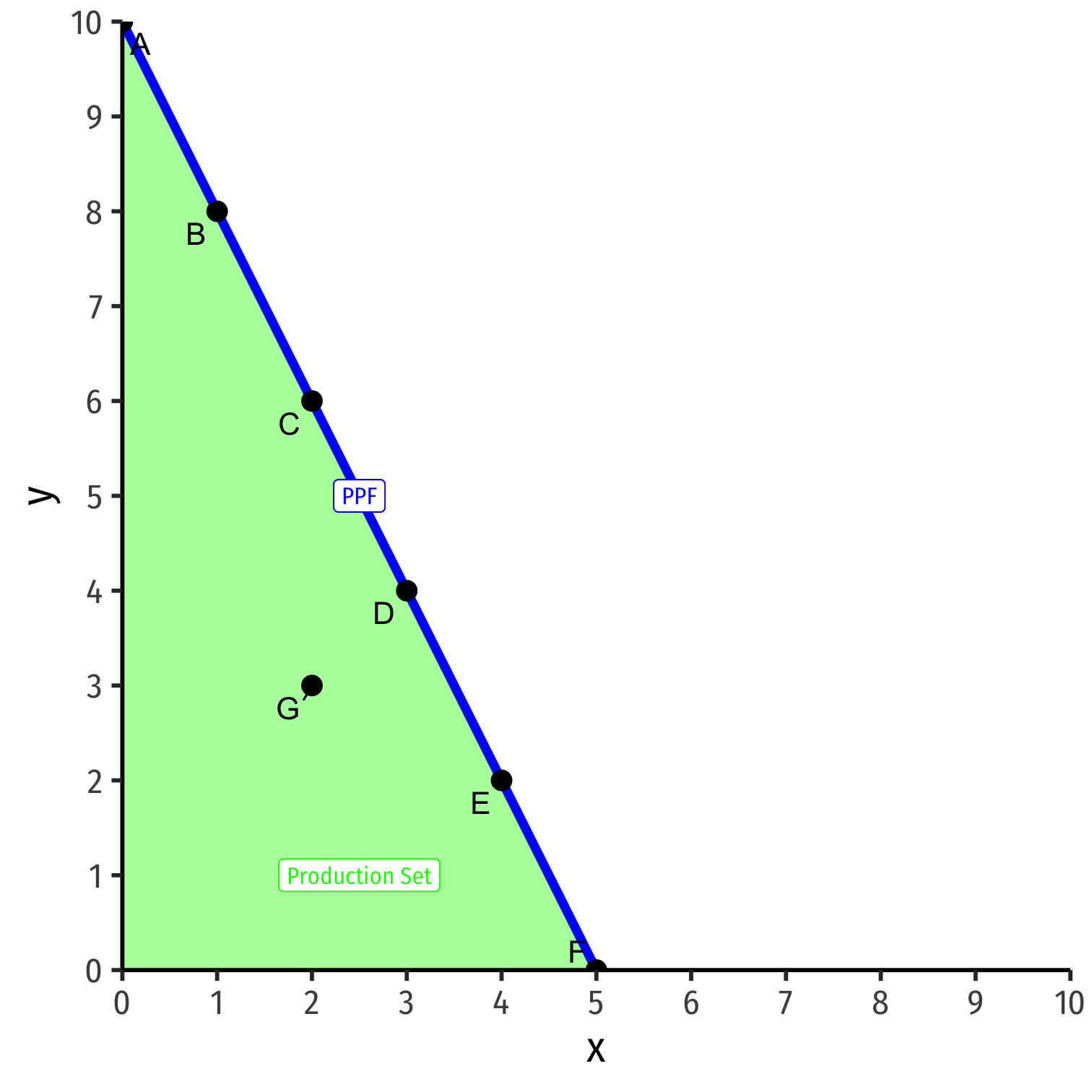

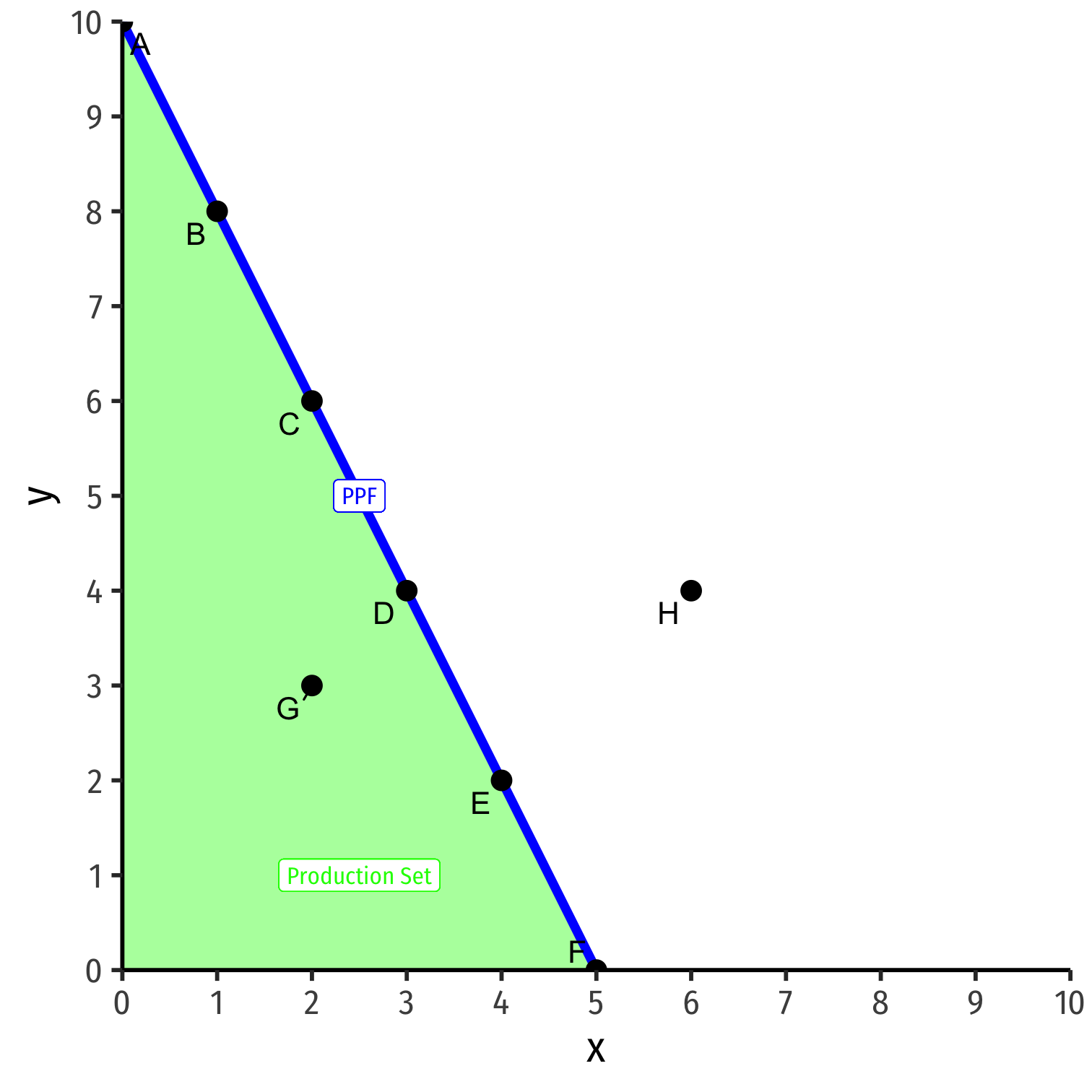

Points on the frontier are efficient (uses all available labor supply)

- Points A-F

Points beneath the frontier are feasible (in production set) but inefficient (does not use all available labor supply)

- Point G

Points above the frontier are impossible with current constraints (endowment, technology, trading opportunities)

- Point H

A Simple Example of Comparative Advantage

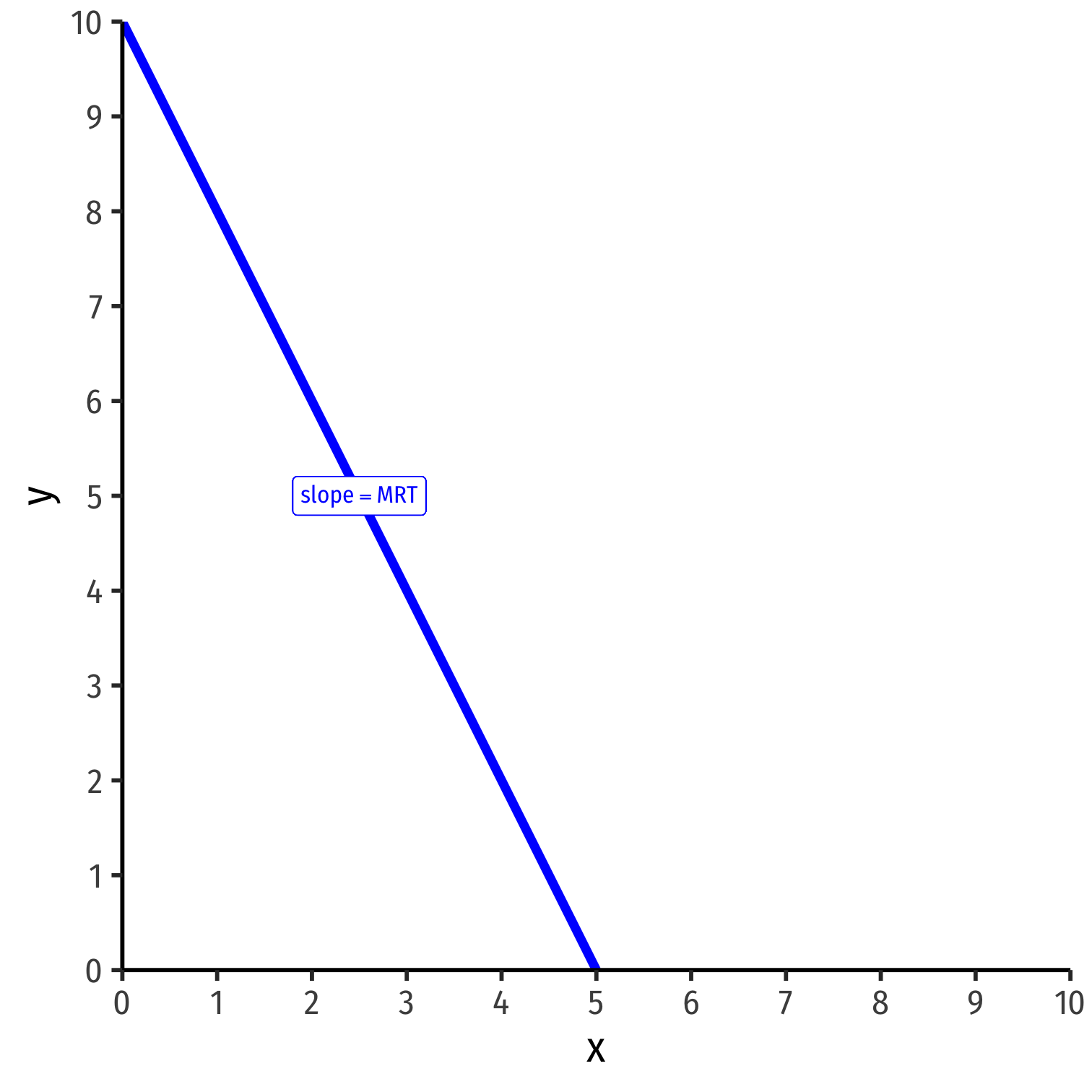

Slope of PPF: marginal rate of transformation (MRT)

Rate at which (domestic) market values tradeoff between goods x and y

Relative price of x (in terms of y), or opportunitiy cost of x: how many units of y must be given up to produce one more unit of x

A Numerical Example

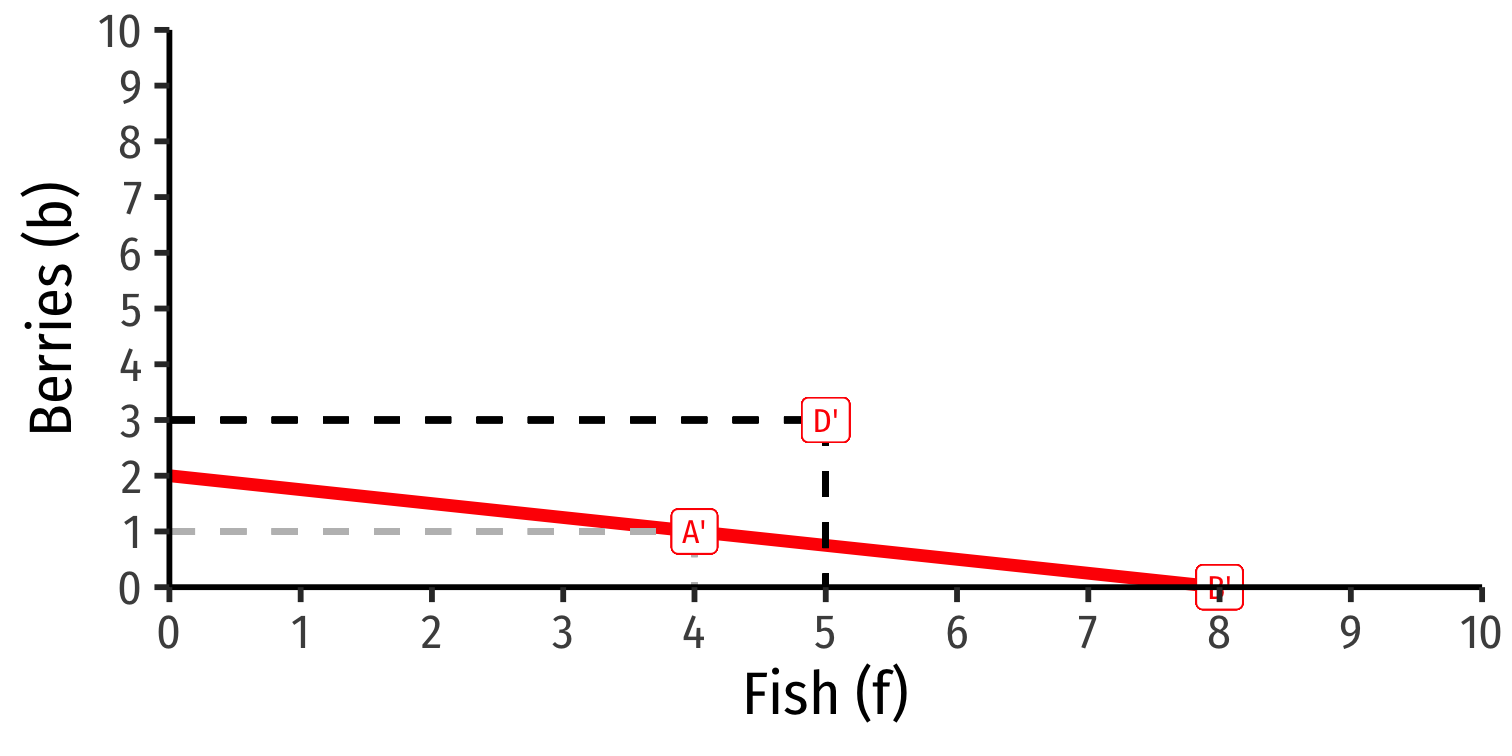

- Suppose the two goods on the island are fish (f) and berries (b)

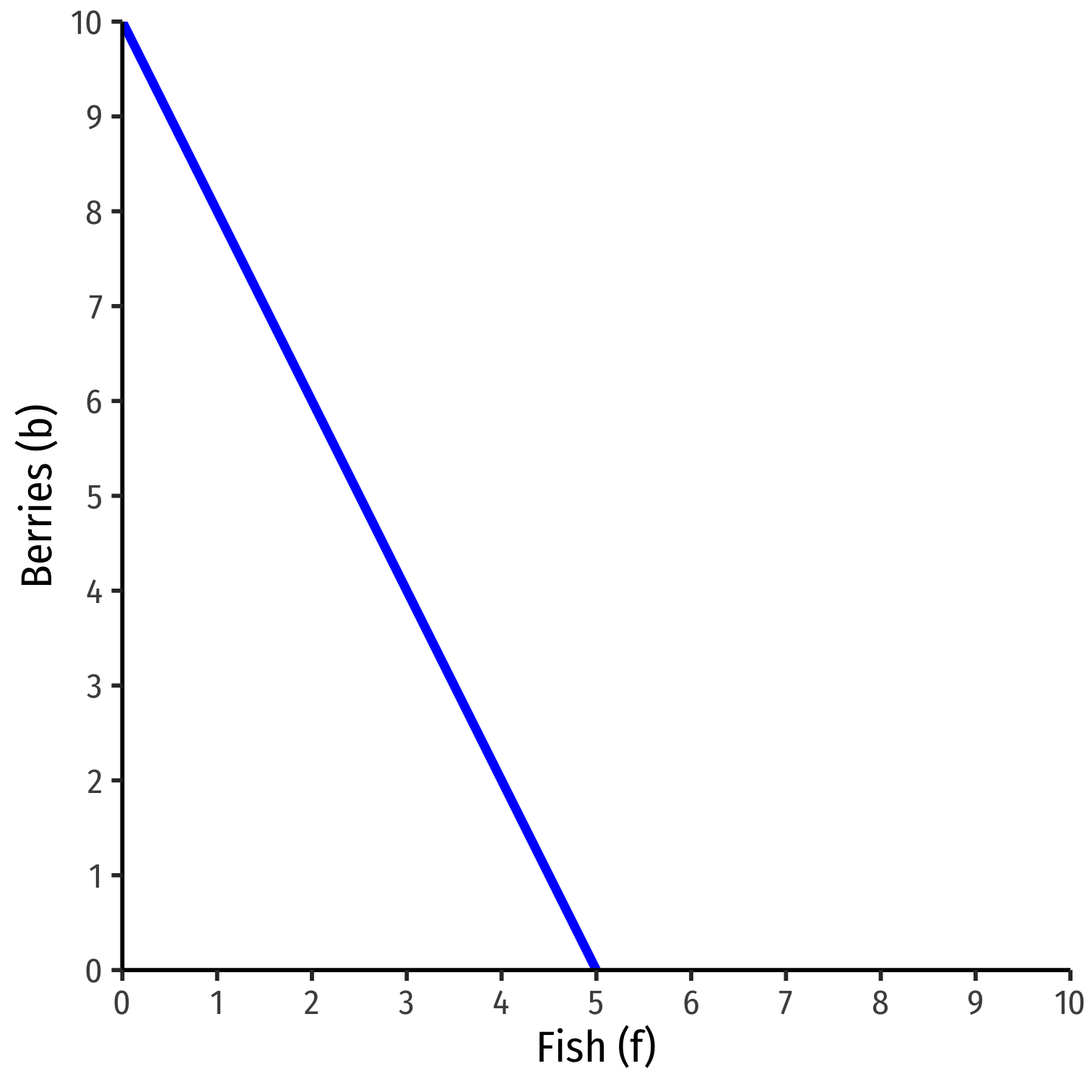

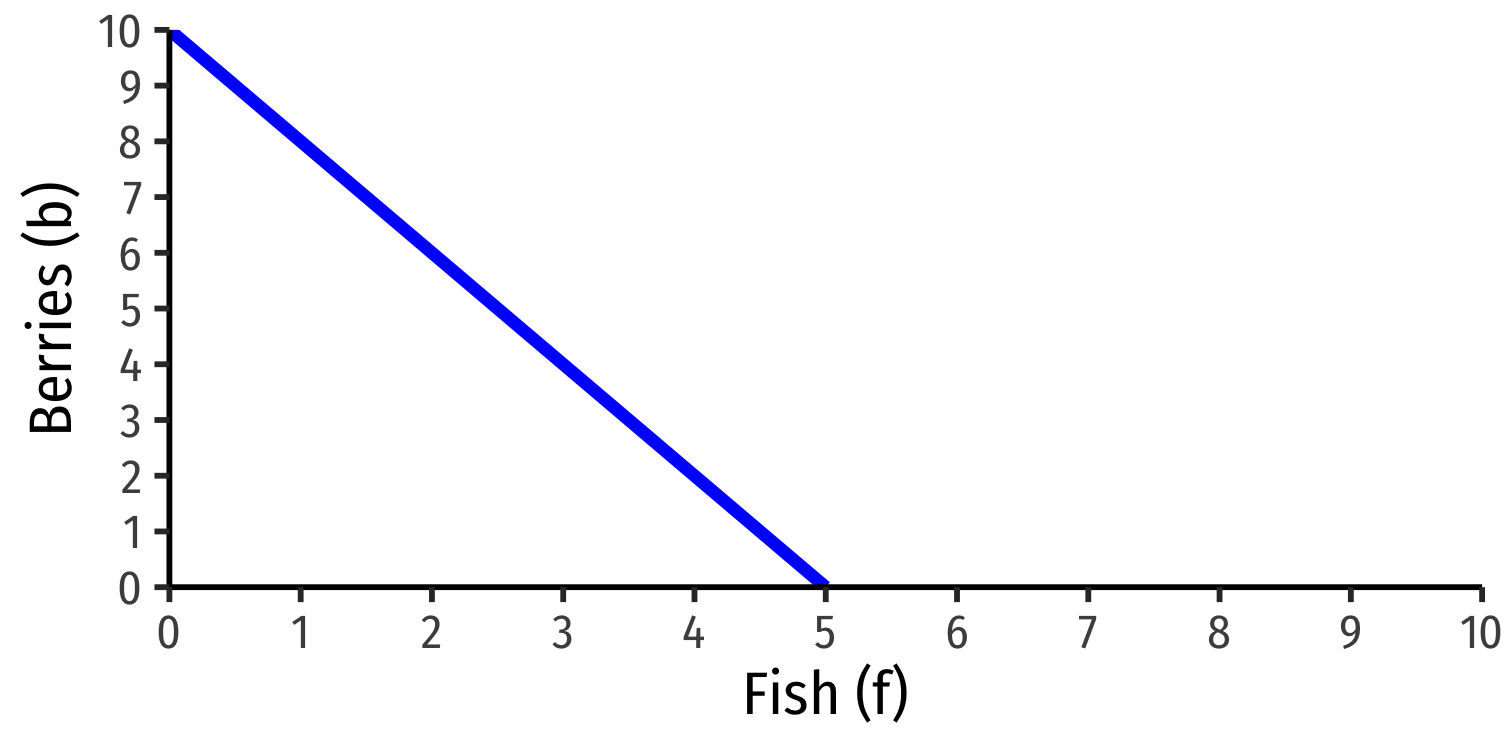

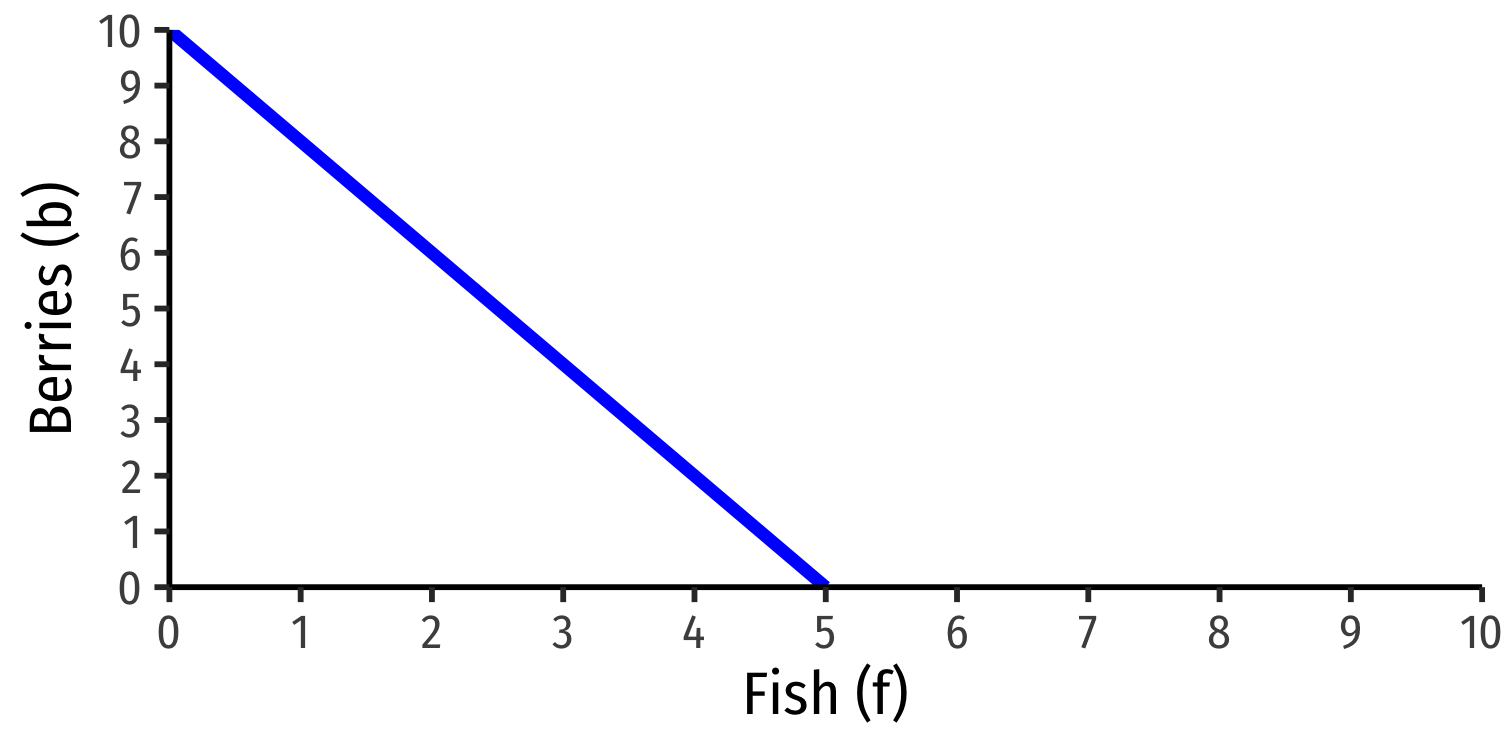

A Numerical Example

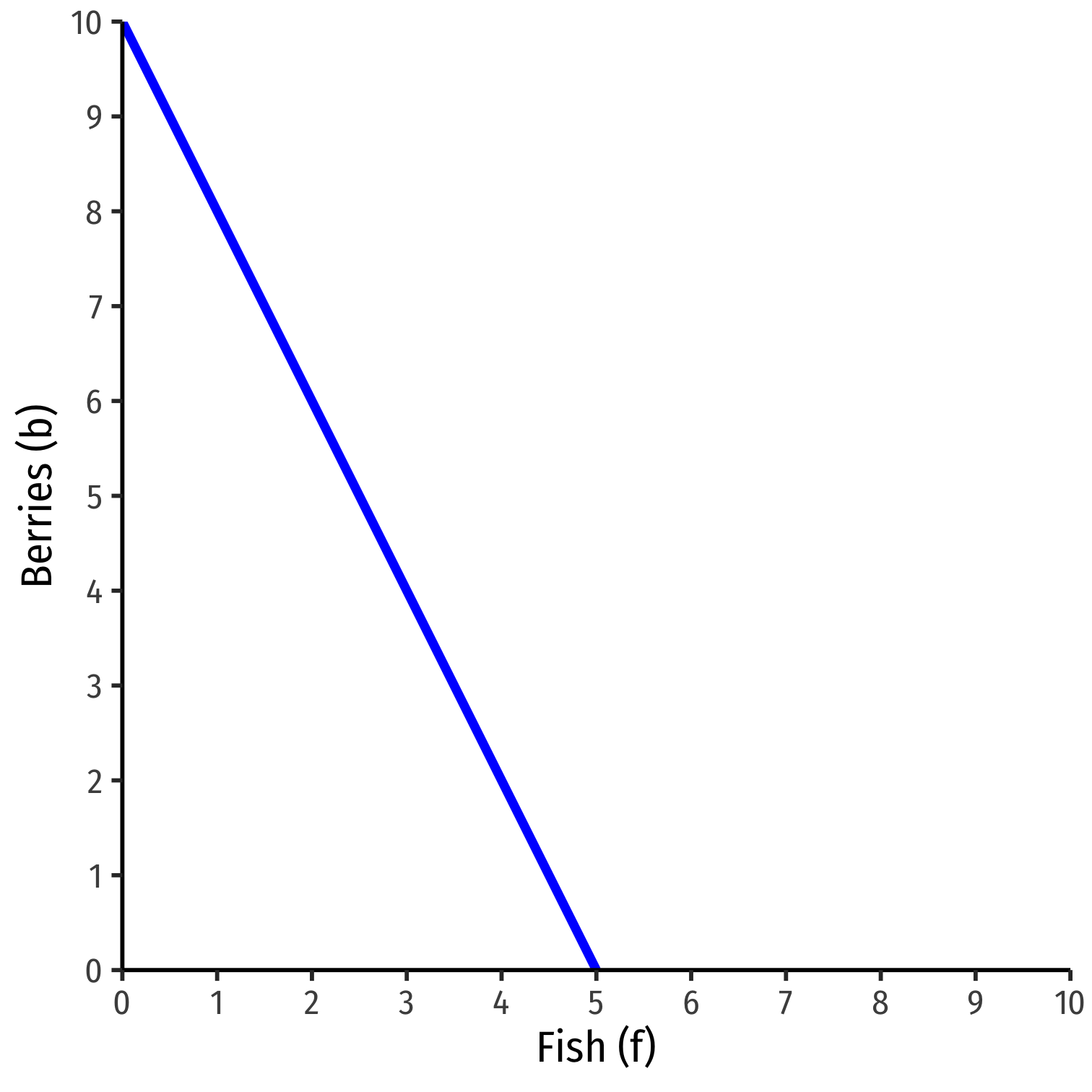

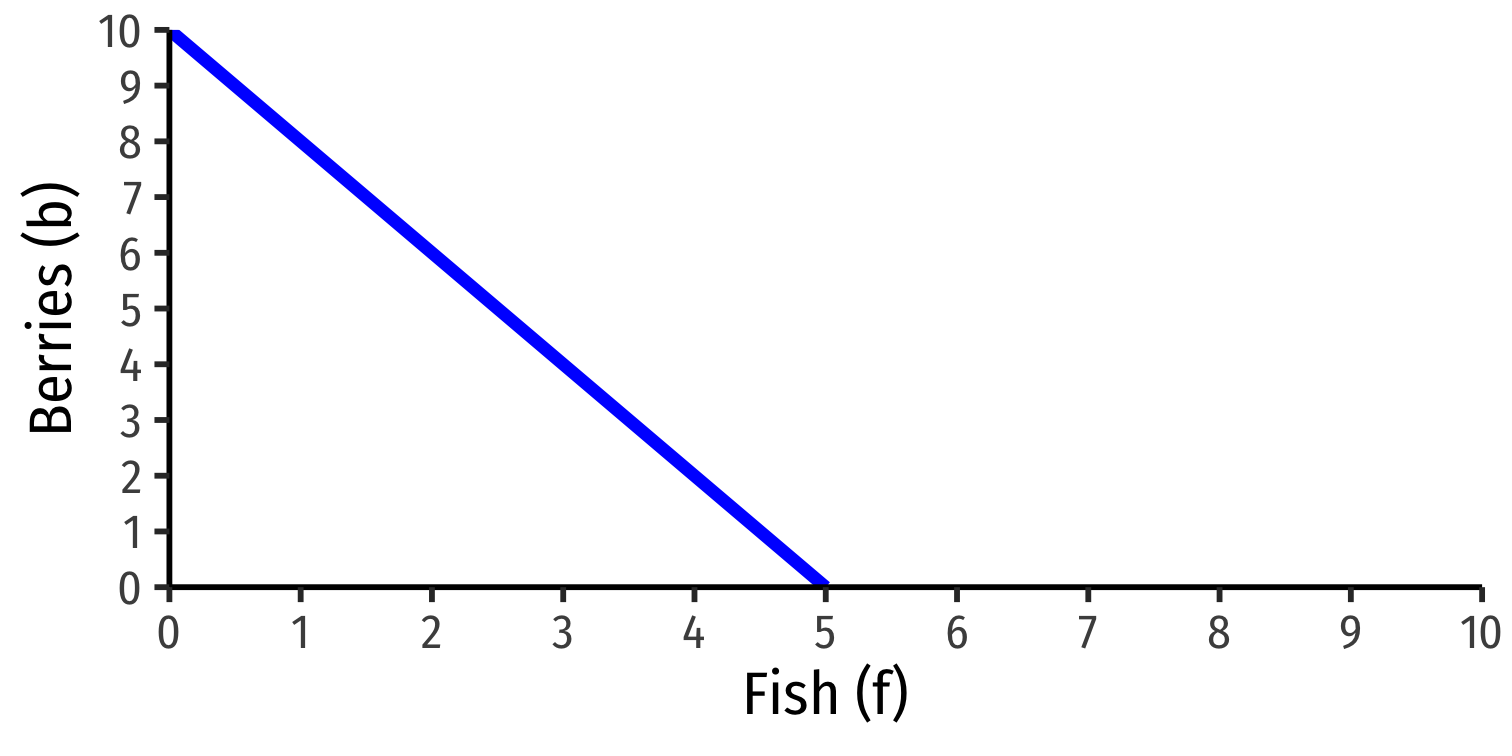

Suppose the two goods on the island are fish (f) and berries (b)

Can represent the PPF as a linear function:

b=10−2f

A Numerical Example

Suppose the two goods on the island are fish (f) and berries (b)

Can represent the PPF as a linear function:

b=10−2f

- Slope: −2

- Opportunity cost of 1f: 2b

A Numerical Example

Suppose the two goods on the island are fish (f) and berries (b)

Can represent the PPF as a linear function:

b=10−2f

- Slope: −2

- Opportunity cost of 1f: 2b

- Opportunity cost of 1b: 12f

- Hint: use the endpoints!

A Numerical Example

Suppose the two goods on the island are fish (f) and berries (b)

Can represent the PPF as a linear function:

b=10−2f

- Slope: −2

- Opportunity cost of 1f: 2b

- Opportunity cost of 1b: 12f

Meeting Friday

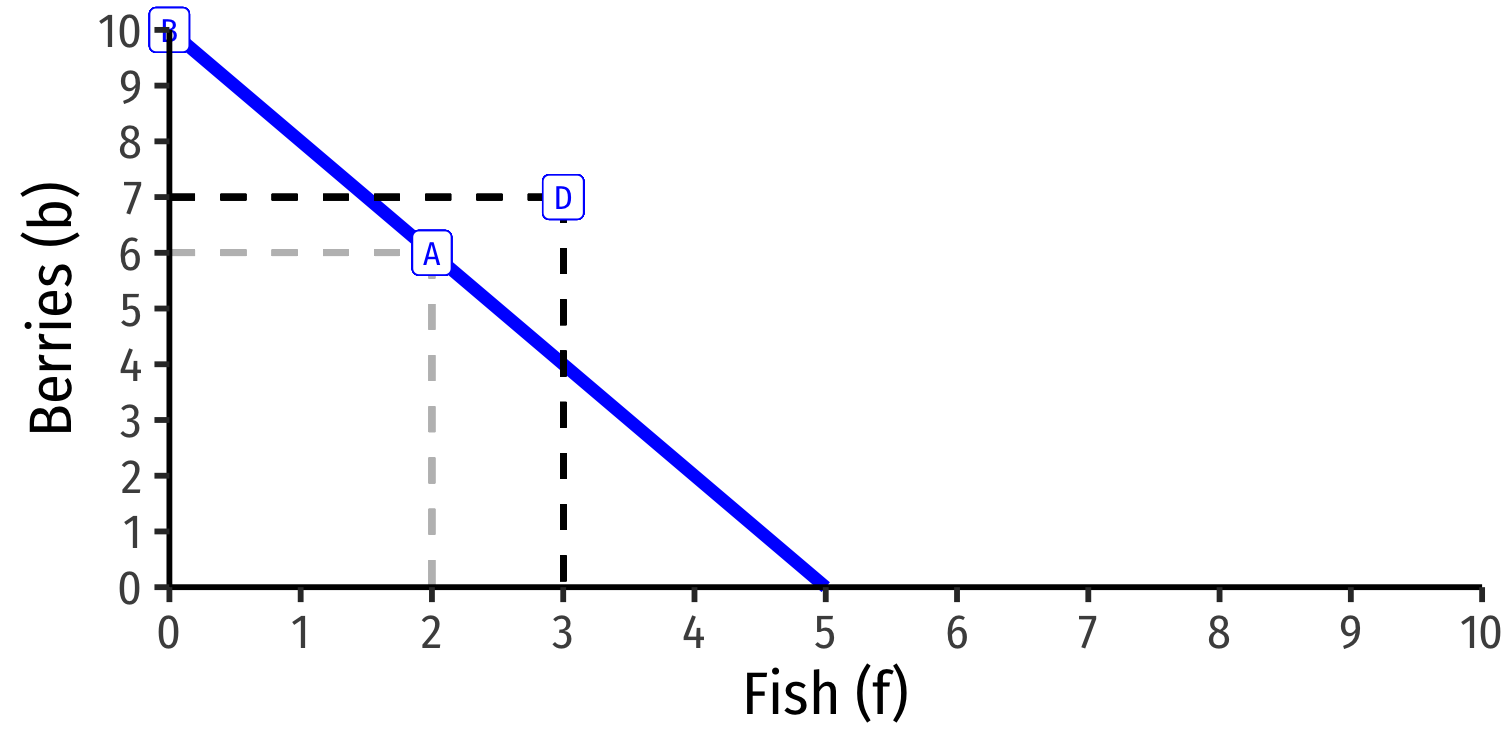

Crusoe

Friday

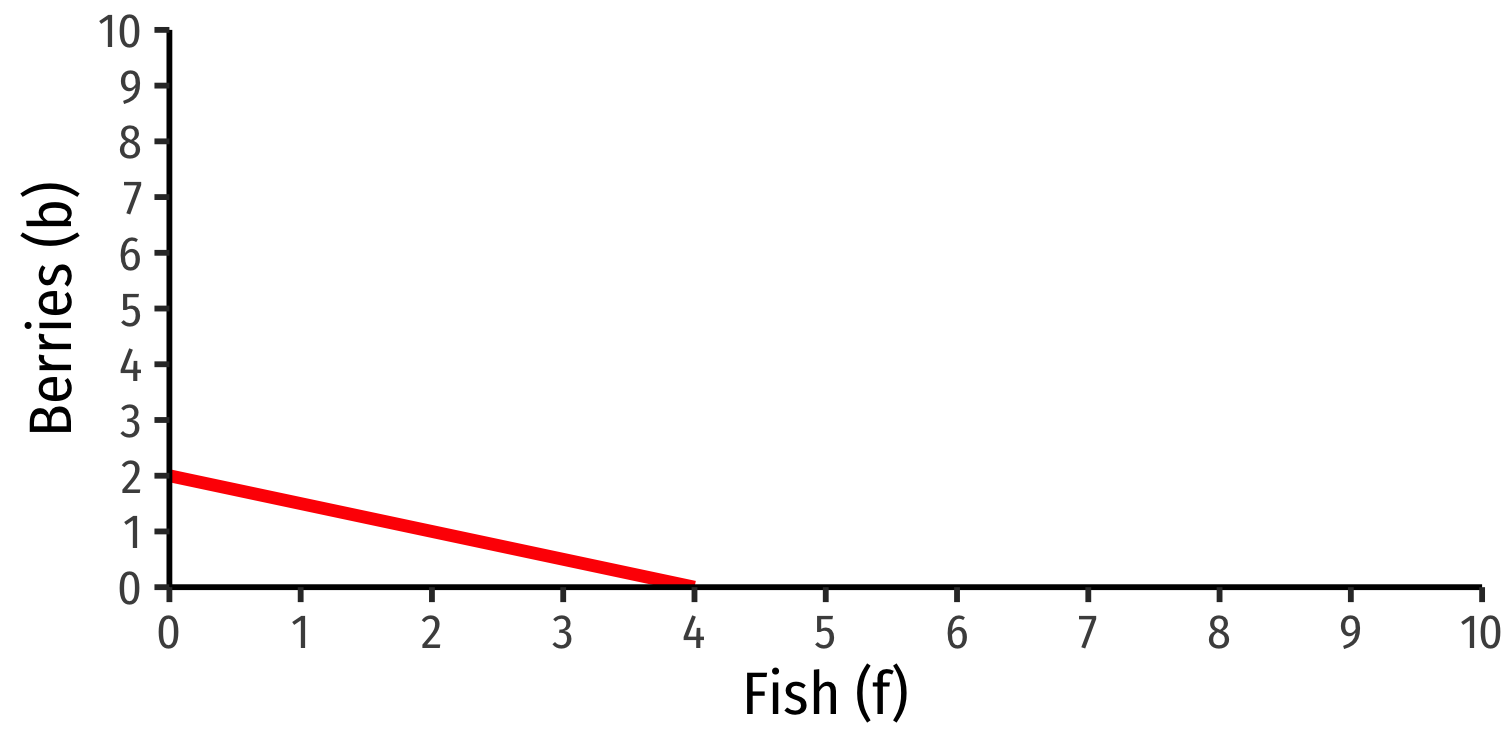

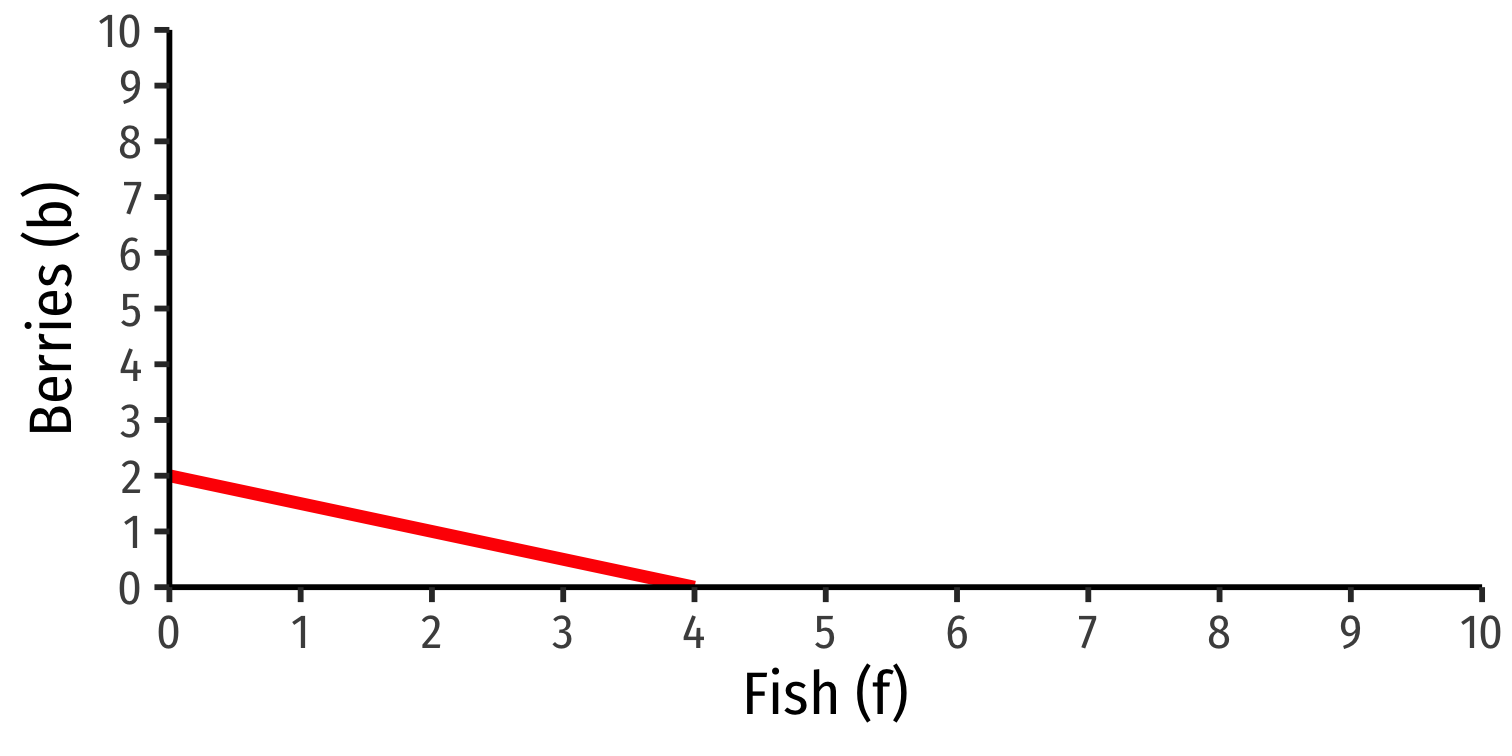

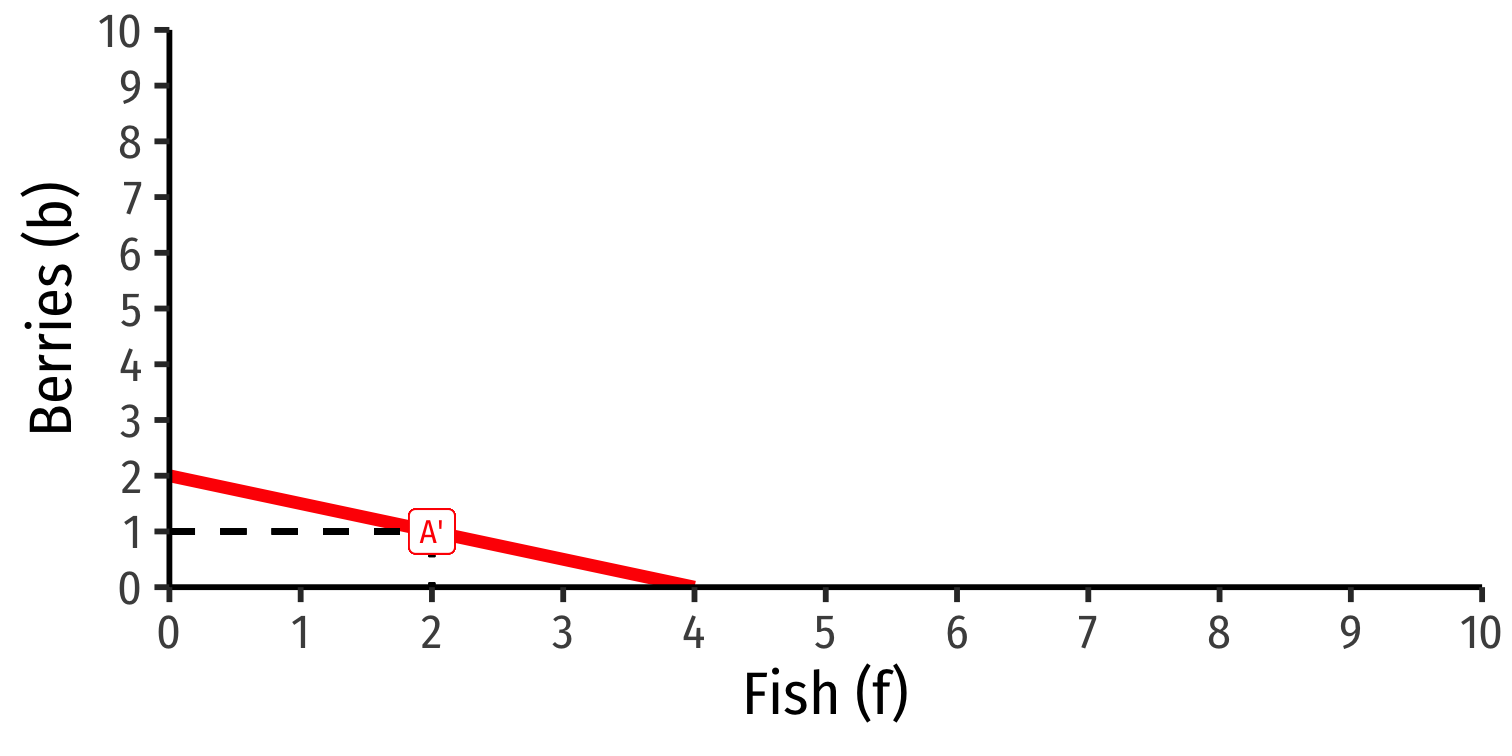

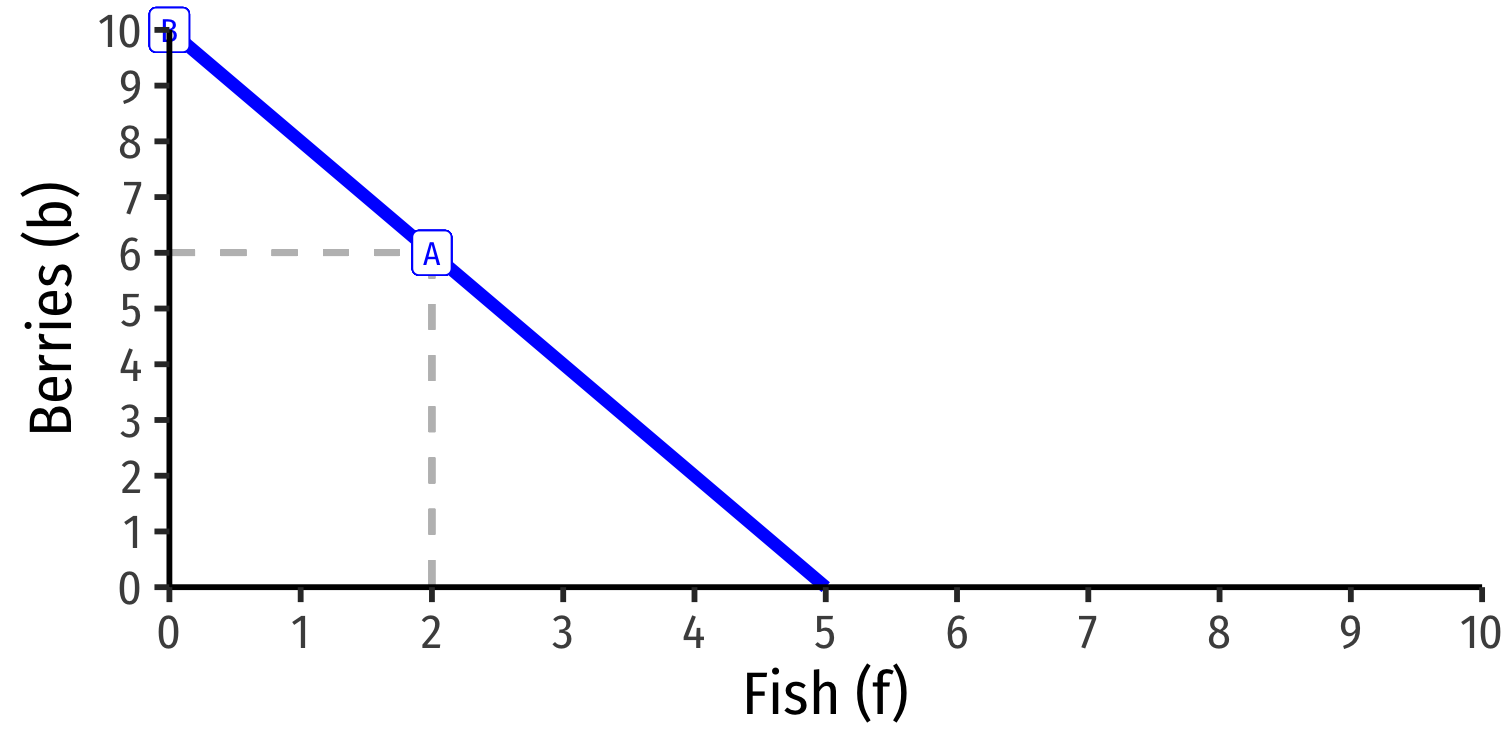

Meeting Friday

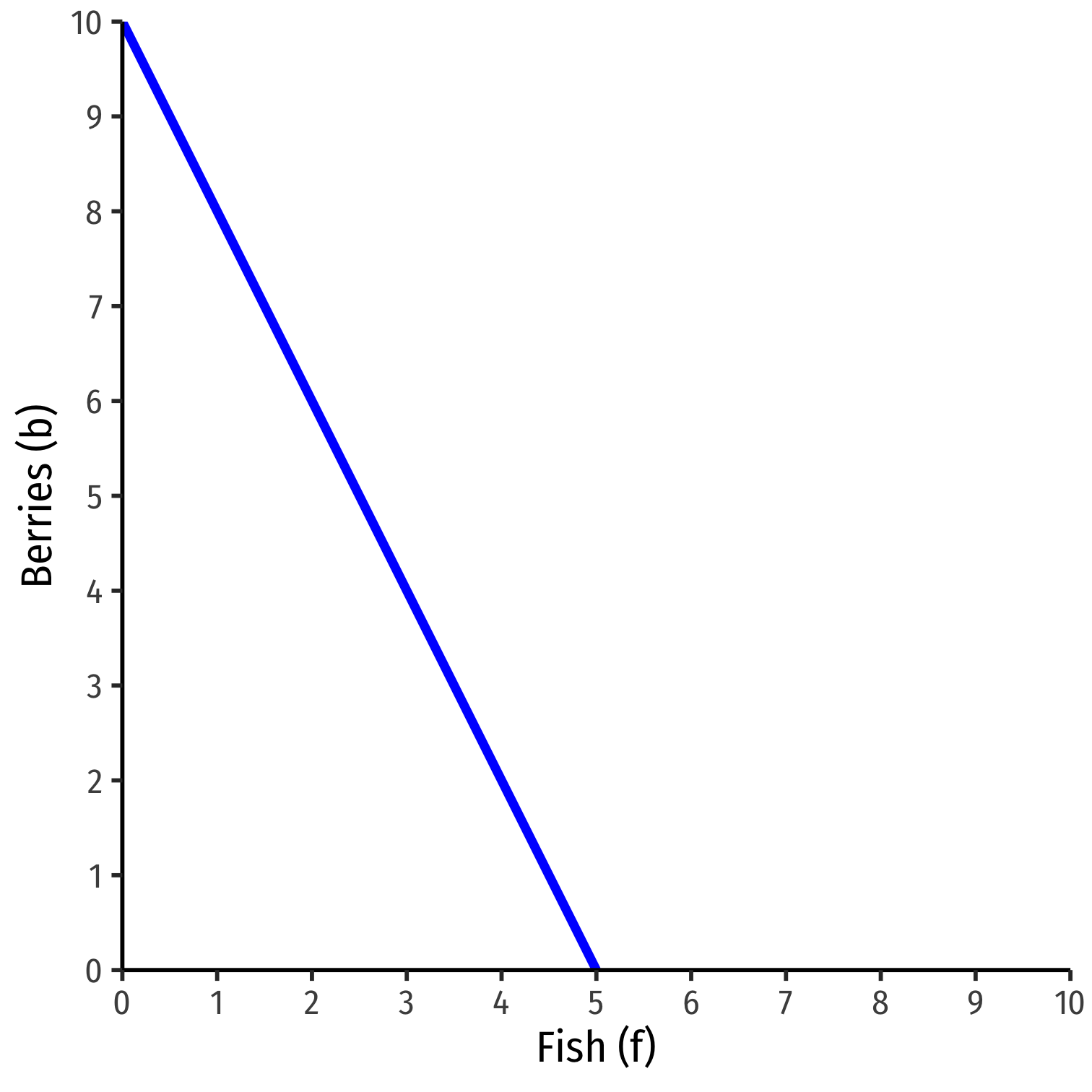

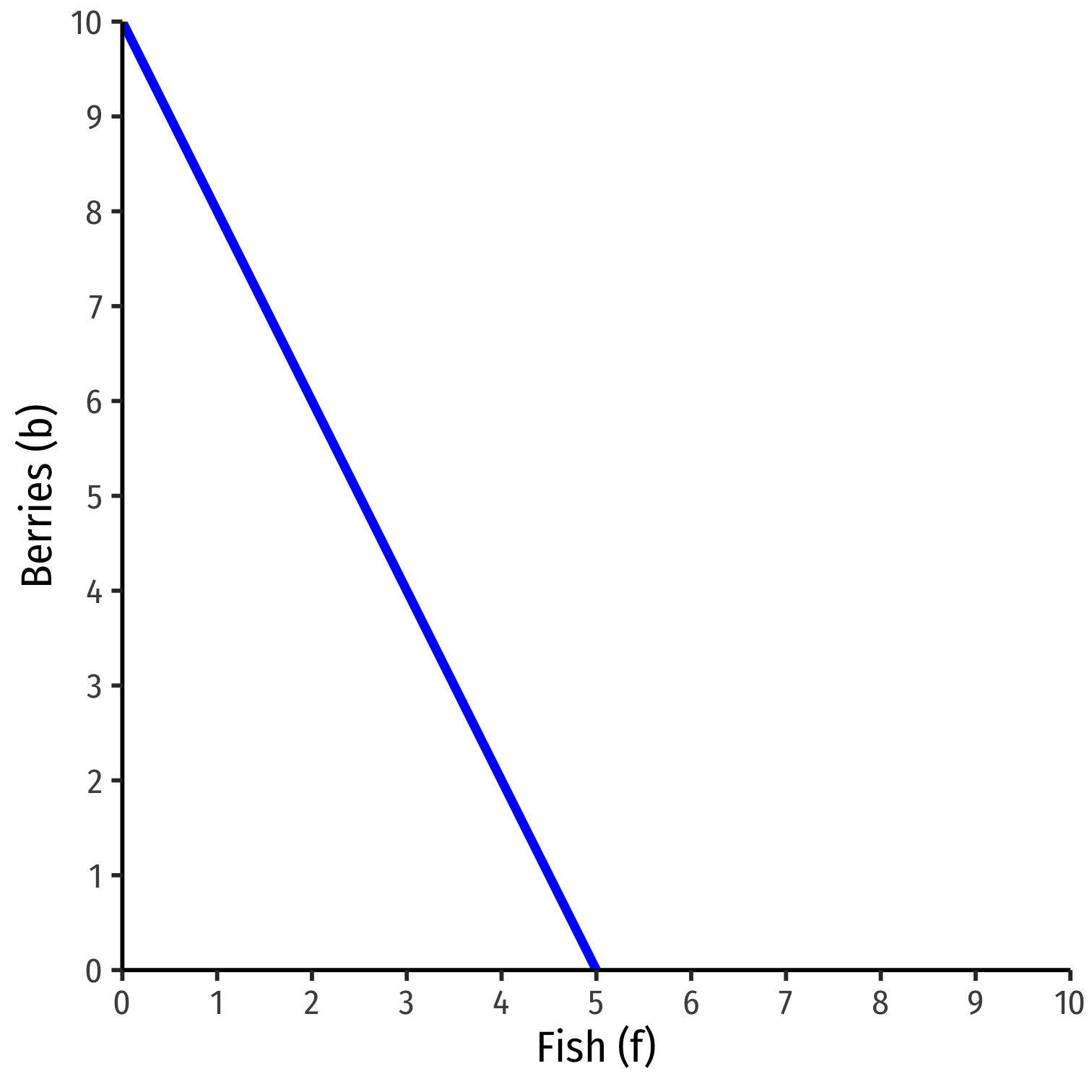

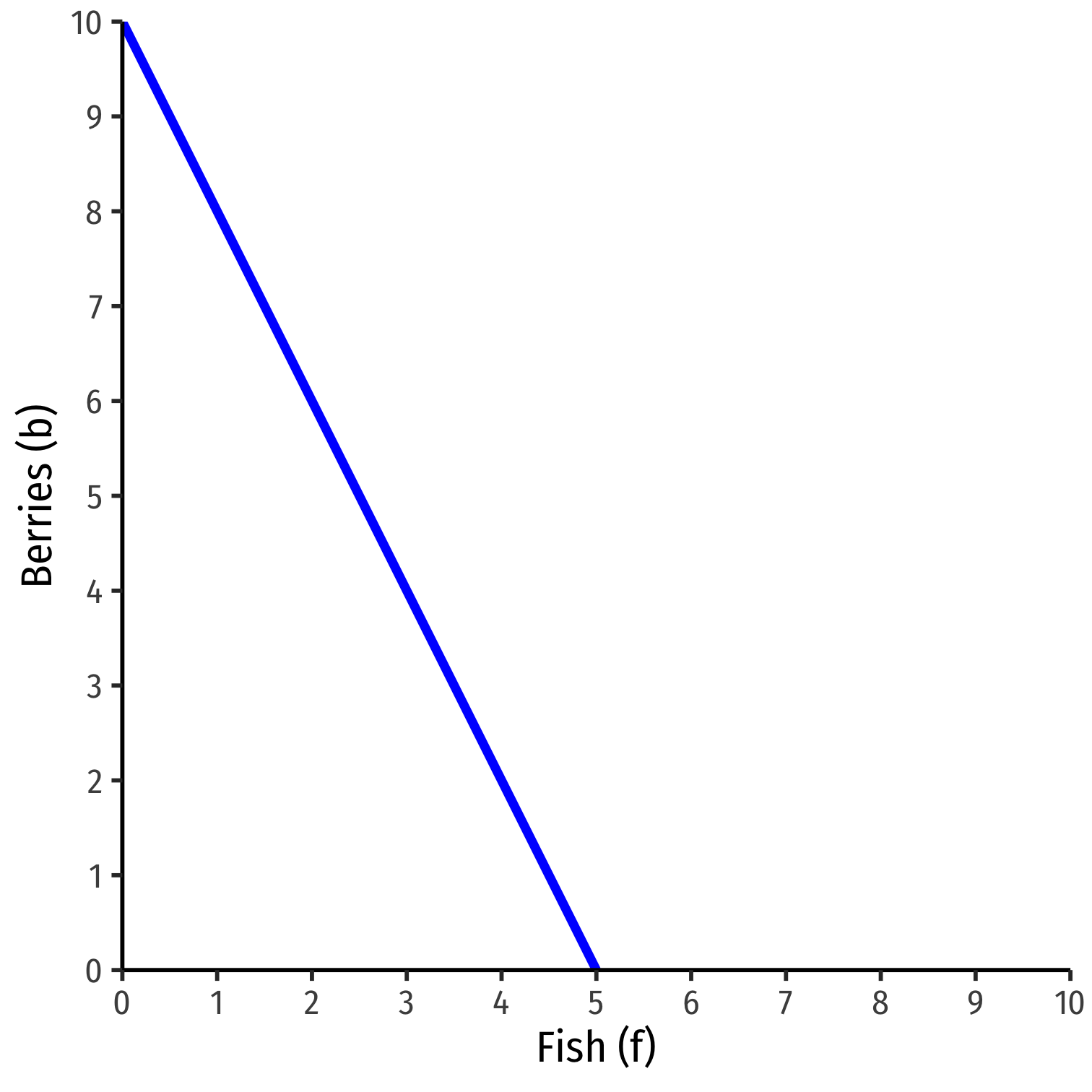

Crusoe

Crusoe’s PPF: b=10−2f

Friday

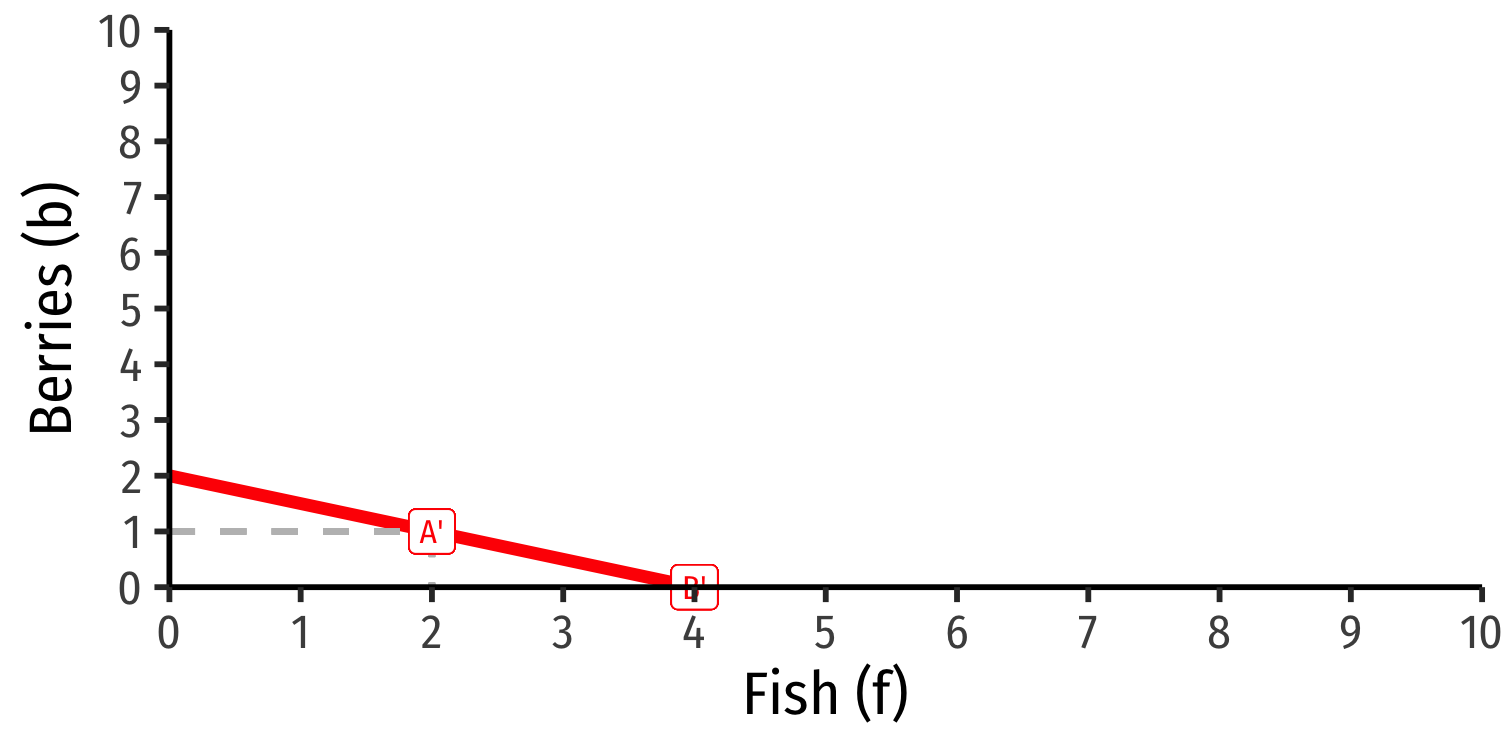

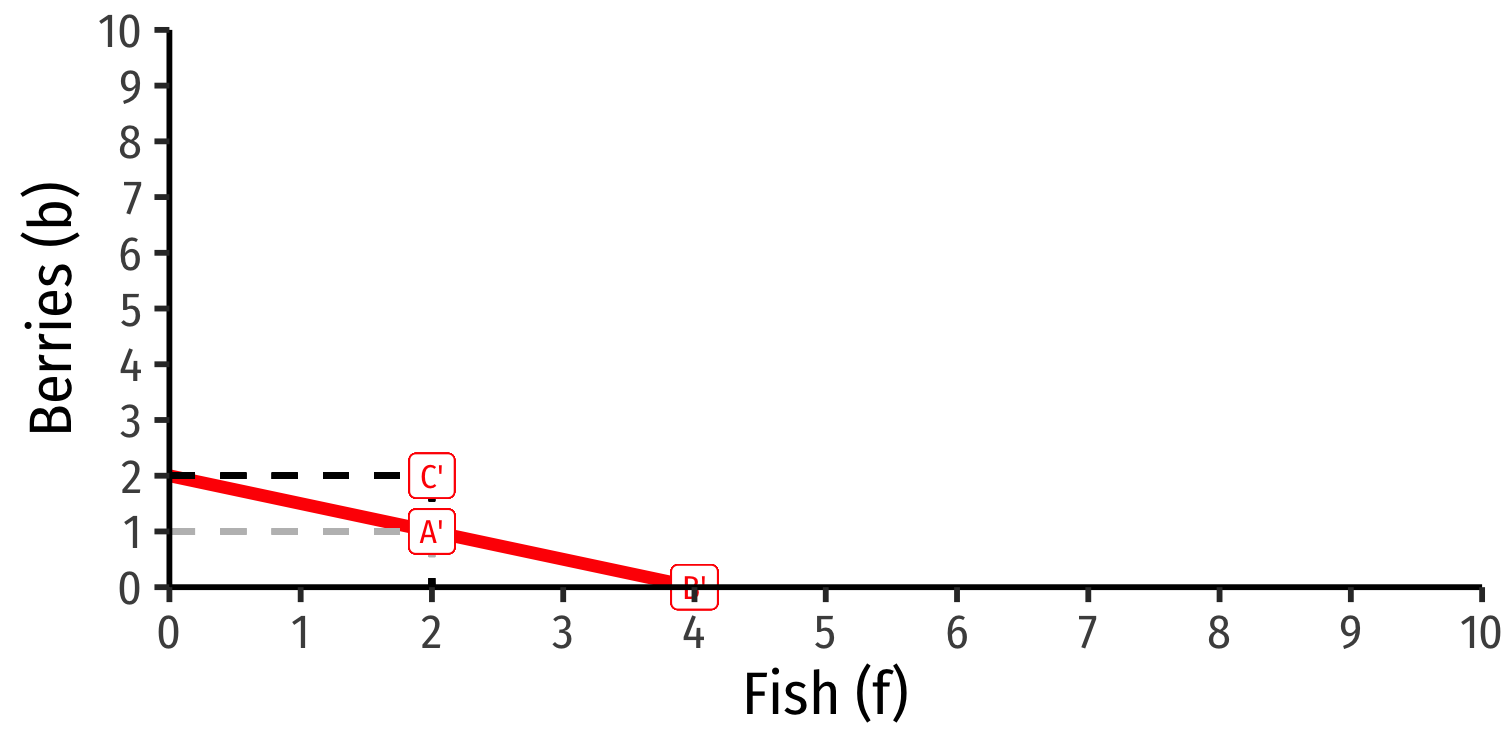

Meeting Friday

Crusoe

Crusoe’s PPF: b=10−2f

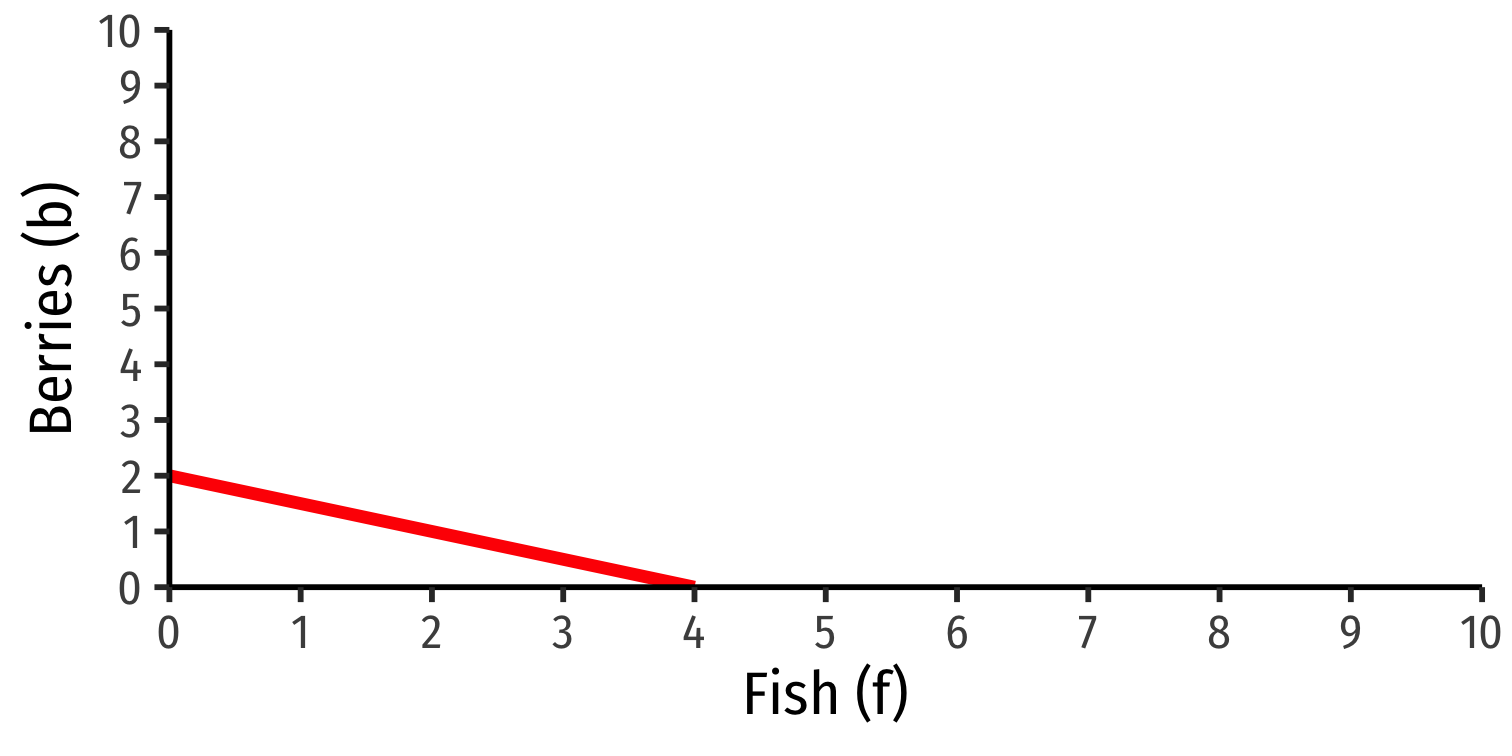

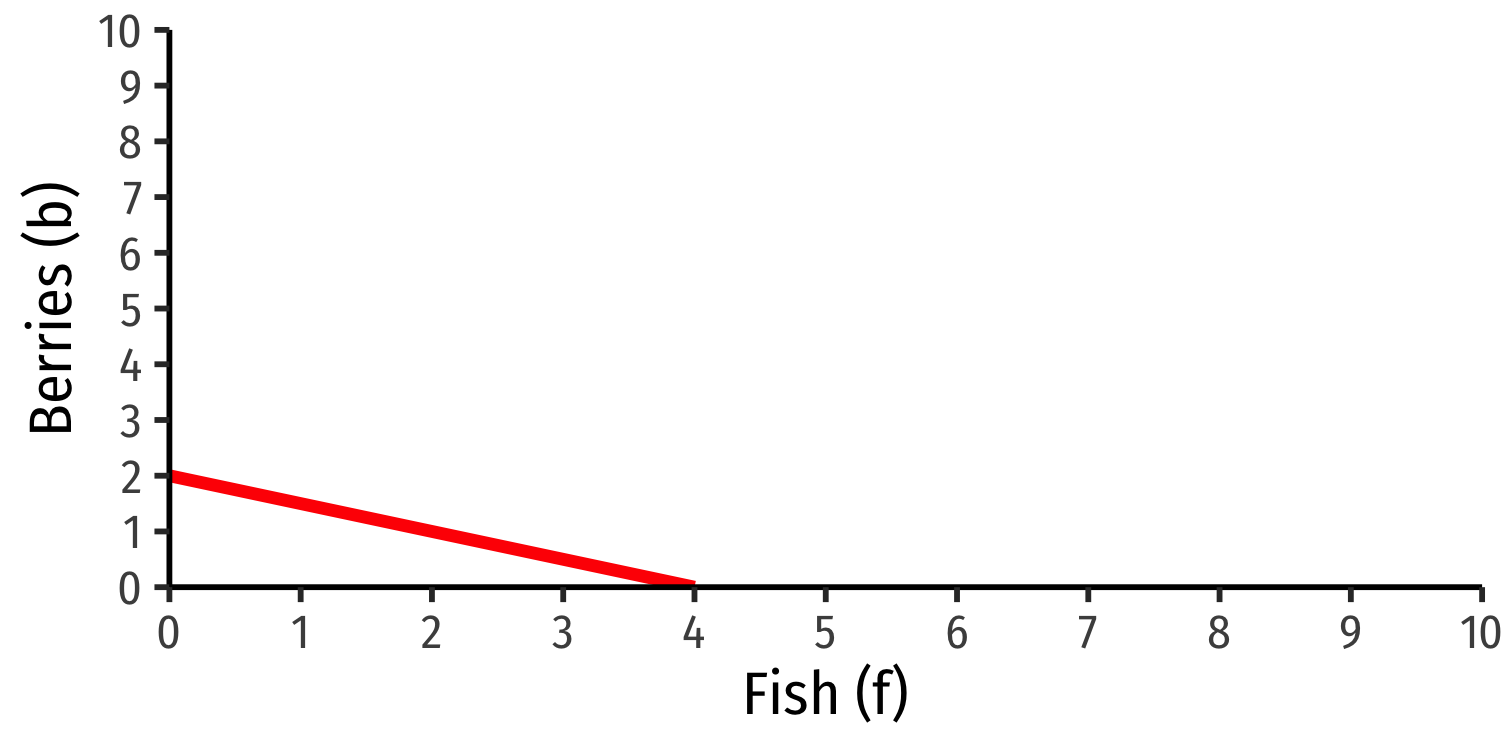

Friday

Friday’s PPF: b=2−12f

Meeting Friday

Crusoe

Crusoe’s PPF: b=10−2f

Crusoe’s opportunity cost of 1f: 2b

Friday

Friday’s PPF: b=2−12f

Friday’s opportunity cost of 1f: 12b

Meeting Friday

Crusoe

Crusoe’s PPF: b=10−2f

Crusoe’s opportunity cost of 1f: 2b

Crusoe’s opportunity cost of 1b: 12f

Friday

Friday’s PPF: b=2−12f

Friday’s opportunity cost of 1f: 12b

Friday’s opportunity cost of 1b: 2f

Production Potentials

Maximum Possible Production

| Fish | Berries | |

|---|---|---|

| Crusoe | 5 | 10 |

| Friday | 4 | 2 |

| TOTAL | 9 | 12 |

Production Potentials

Maximum Possible Production

| Fish | Berries | |

|---|---|---|

| Crusoe | 5 | 10 |

| Friday | 4 | 2 |

| TOTAL | 9 | 12 |

- Why should Crusoe trade with Friday? Crusoe has an absolute advantage in everything!

Production Potentials

Maximum Possible Production

| Fish | Berries | |

|---|---|---|

| Crusoe | 5 | 10 |

| Friday | 4 | 2 |

| TOTAL | 9 | 12 |

Opportunity Costs

| 1 Fish | 1 Berry | |

|---|---|---|

| Crusoe | 2b | 0.5f |

| Friday | 0.5b | 2f |

- Different opportunity costs imply differing comparative advantages!

Production Potentials

Maximum Possible Production

| Fish | Berries | |

|---|---|---|

| Crusoe | 5 | 10 |

| Friday | 4 | 2 |

| TOTAL | 9 | 12 |

Opportunity Costs

| 1 Fish | 1 Berry | |

|---|---|---|

| Crusoe | 2b | 0.5f |

| Friday | 0.5b | 2f |

Different opportunity costs imply differing comparative advantages!

Person (country) with lower opportunity cost of a particular good should specialize in producing that good

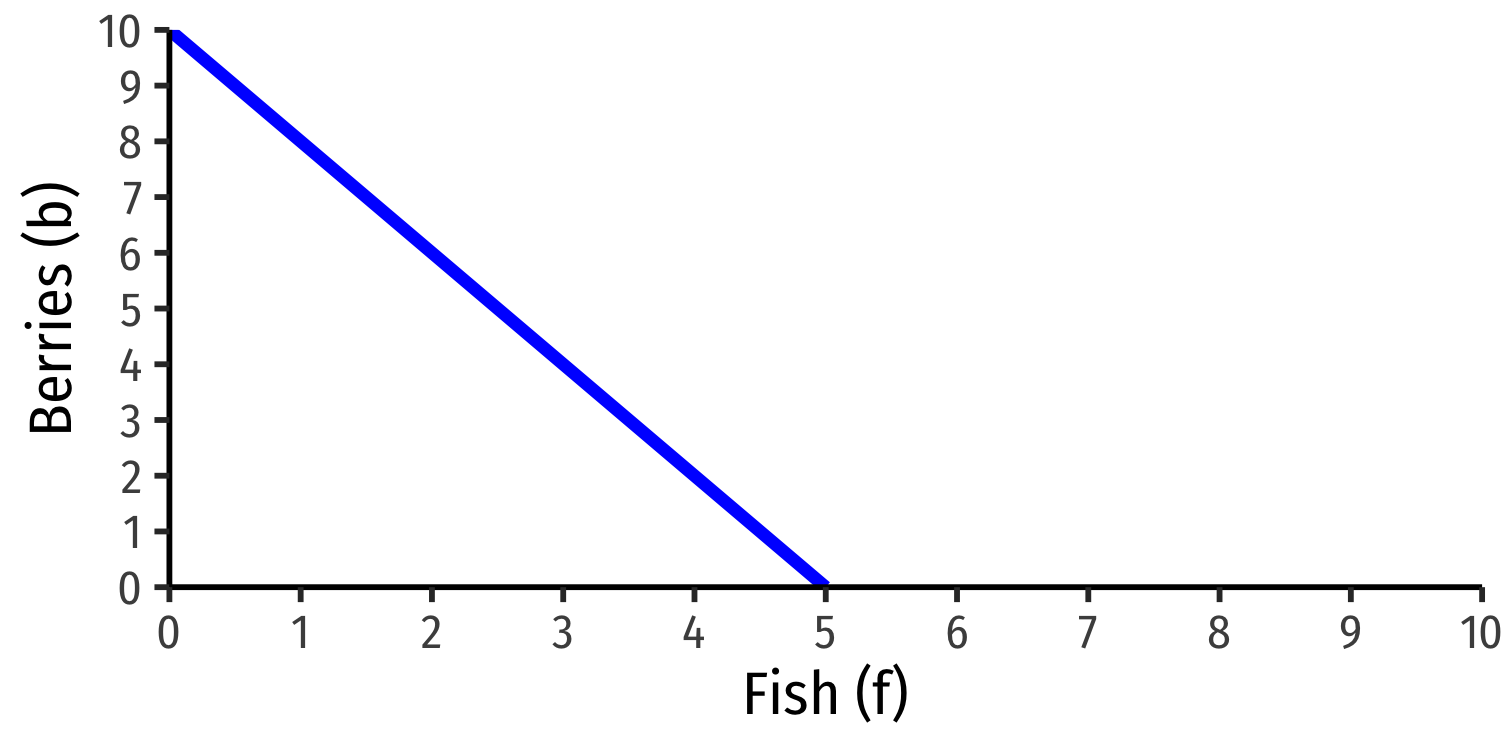

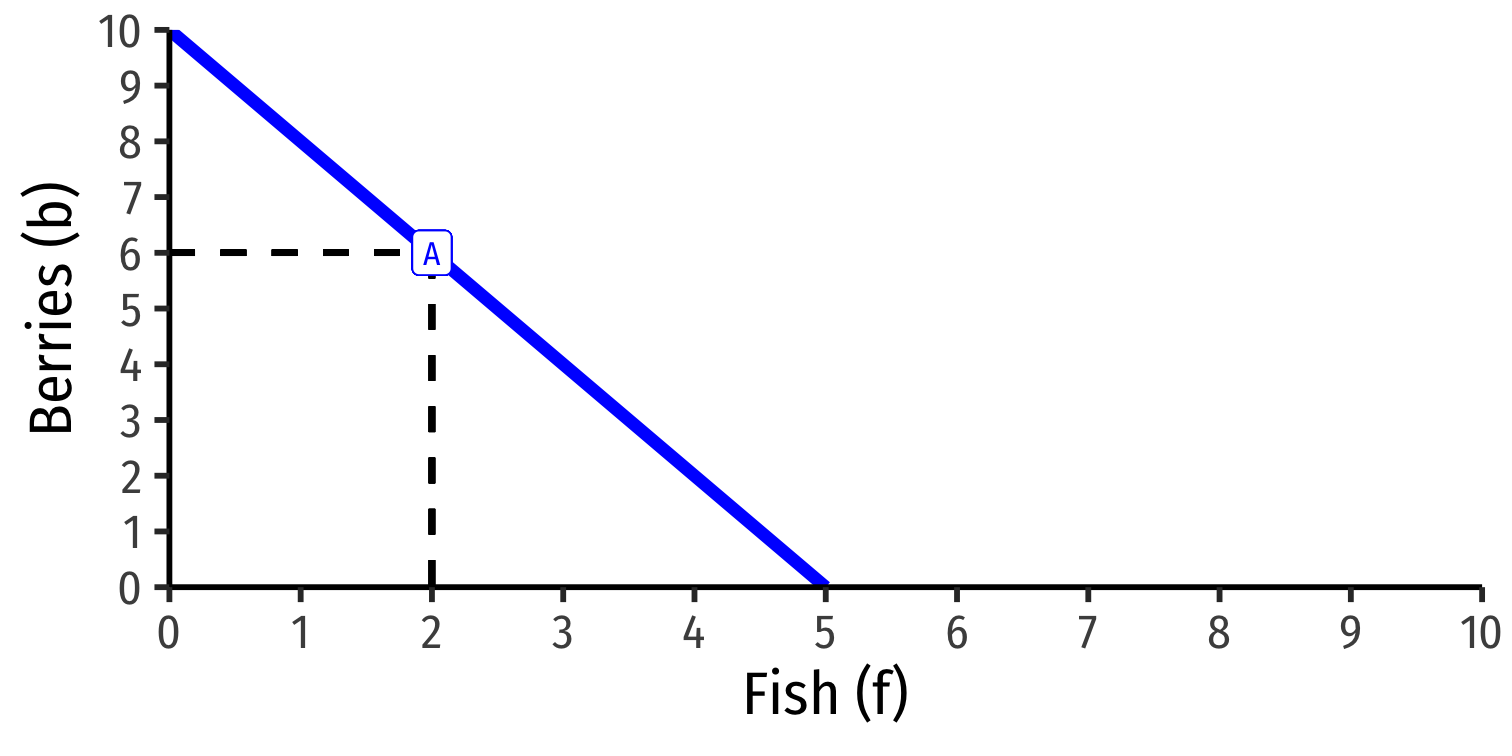

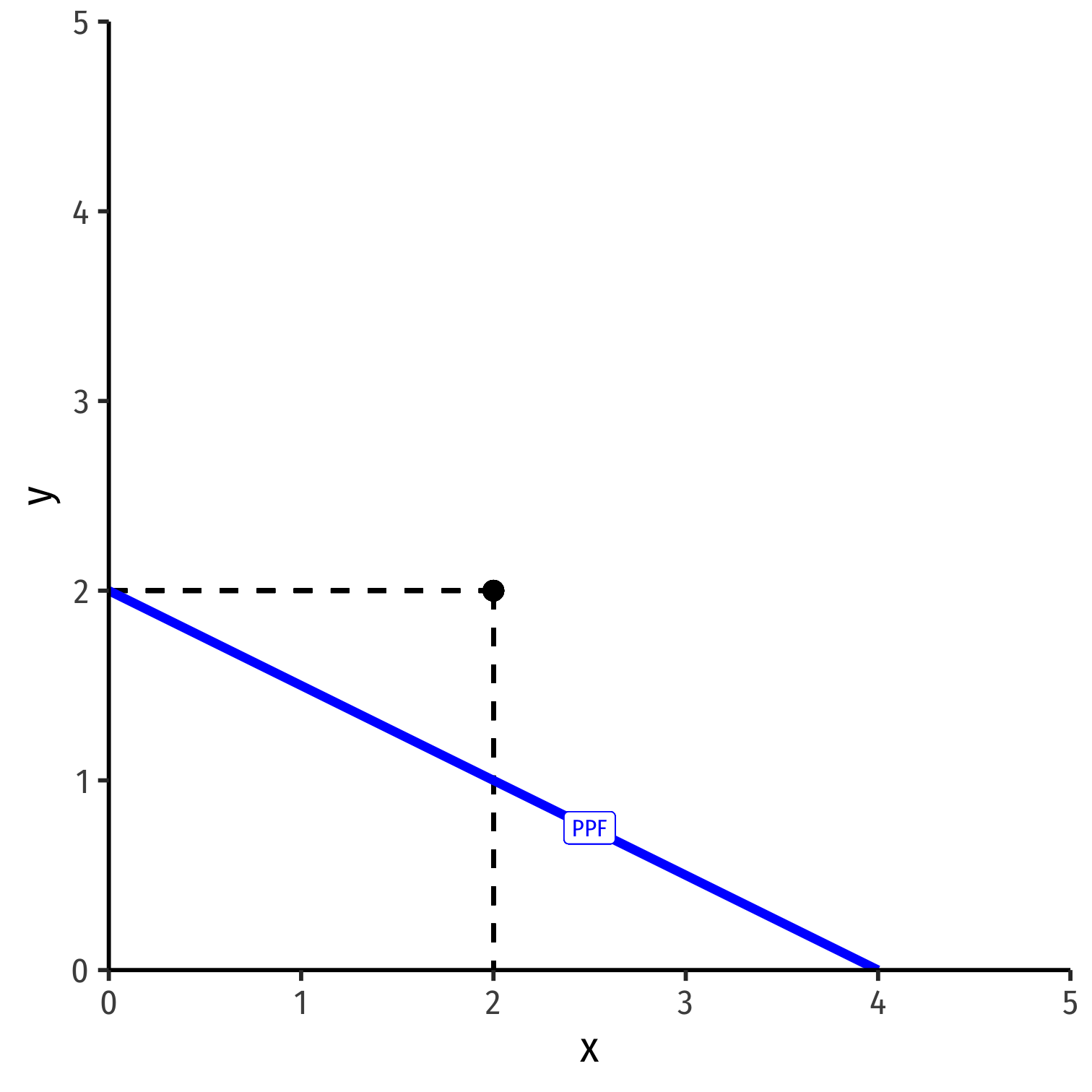

Current Production & Consumption

Crusoe

| Fish | Berries | |

|---|---|---|

| Crusoe | 2 | 6 |

| Friday | 2 | 1 |

Friday

- Each is producing & consuming at an (arbitrary) point on their PPFs (A and A')

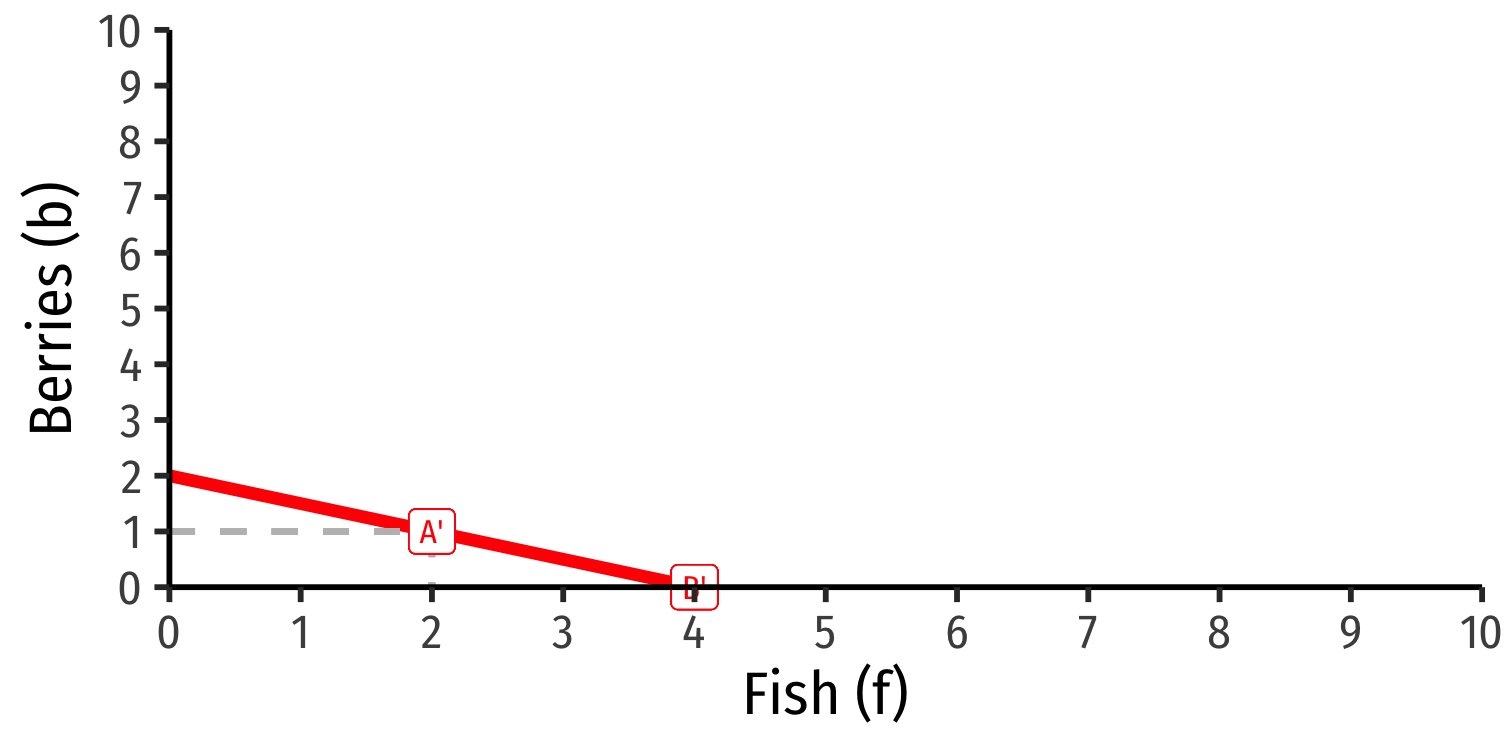

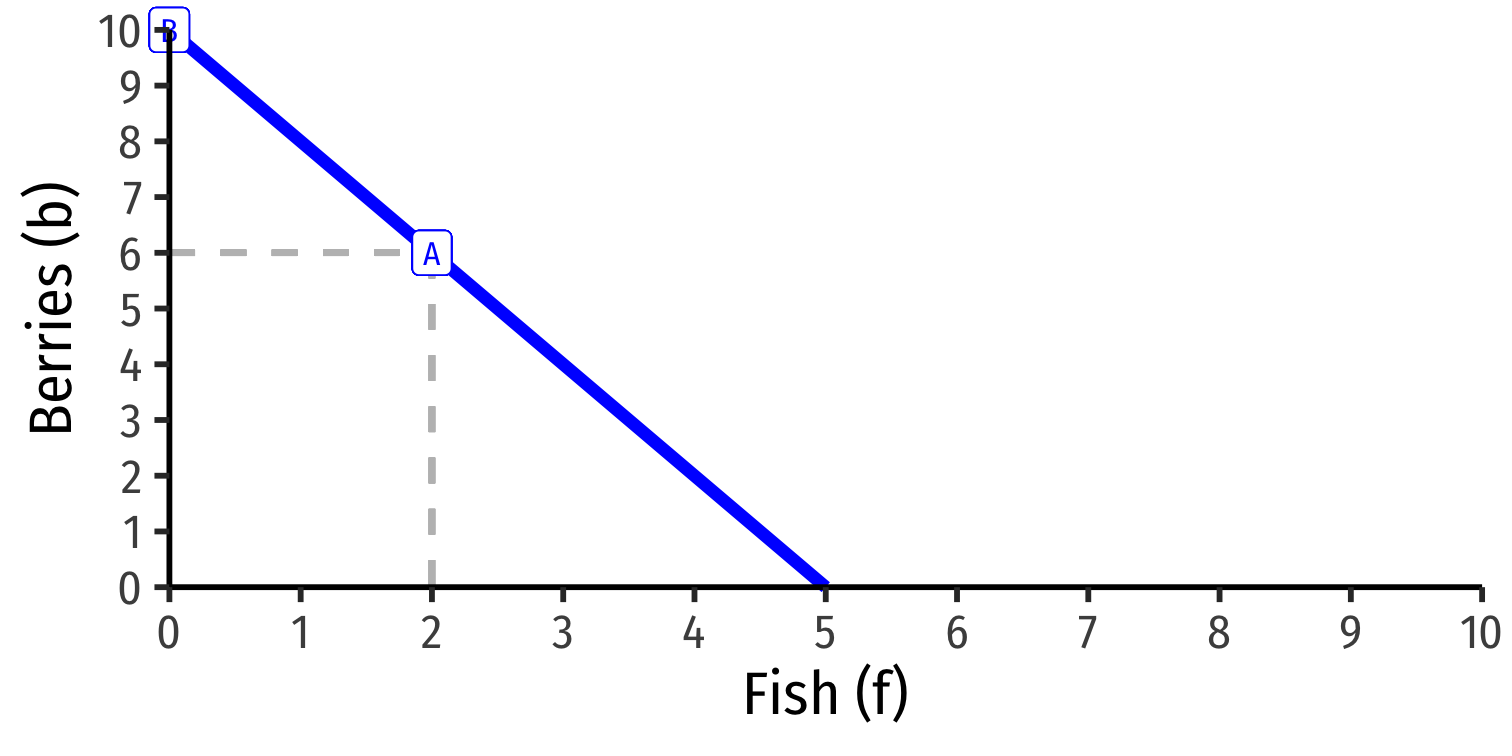

Specialization in Production

Crusoe

| Fish | Berries | |

|---|---|---|

| Crusoe | 0 | 10 |

| Friday | 4 | 0 |

| TOTAL | 4 | 10 |

Friday

- Each then specializes in their comparative advantage (B and B')

Specialization in Production

Crusoe

| Fish | Berries | |

|---|---|---|

| Crusoe | 0 | 10 |

| Friday | 4 | 0 |

| TOTAL | 4 | 10 |

Friday

Each then specializes in their comparative advantage (B and B')

Suppose they agree on the following terms of trade: 1 fish for 1 berry

- Crusoe gives Friday 2 berries for 2 fish

The Terms of Trade

The “terms of trade” are also known as exchange rates or relative prices

(Without money), there are two prices here:

- (berry) price of fish, pf: amount of berries given up for 1 fish

- (fish) price of berries, pb: amount of fish given up for 1 berry

The Terms of Trade

Each party wants to buy at a relative price lower than their own opportunity cost

- Otherwise, “cheaper” to produce it yourself!

Each party wants to sell at a relative price higher than their own opportunity cost

- Otherwise, keep it!

Opportunity Costs

| 1 Fish | 1 Berry | |

|---|---|---|

| Crusoe | 2b | 0.5f |

| Friday | 0.5b | 2f |

The Terms of Trade

Each party wants to buy at a relative price lower than their own opportunity cost

- Otherwise, “cheaper” to produce it yourself!

Each party wants to sell at a relative price higher than their own opportunity cost

- Otherwise, keep it!

12 berry <pf<2 berries

12 fish <pb<2 fish

Opportunity Costs

| 1 Fish | 1 Berry | |

|---|---|---|

| Crusoe | 2b | 0.5f |

| Friday | 0.5b | 2f |

Improvements in Post-Trade Consumption

Crusoe

| Fish | Berries | |

|---|---|---|

| Crusoe | 2 | 8 |

| Friday | 2 | 2 |

| TOTAL | 4 | 10 |

Friday

Gains from exchange: both Crusoe and Friday can comume more than they could possibly produce!

At points above their PPFs

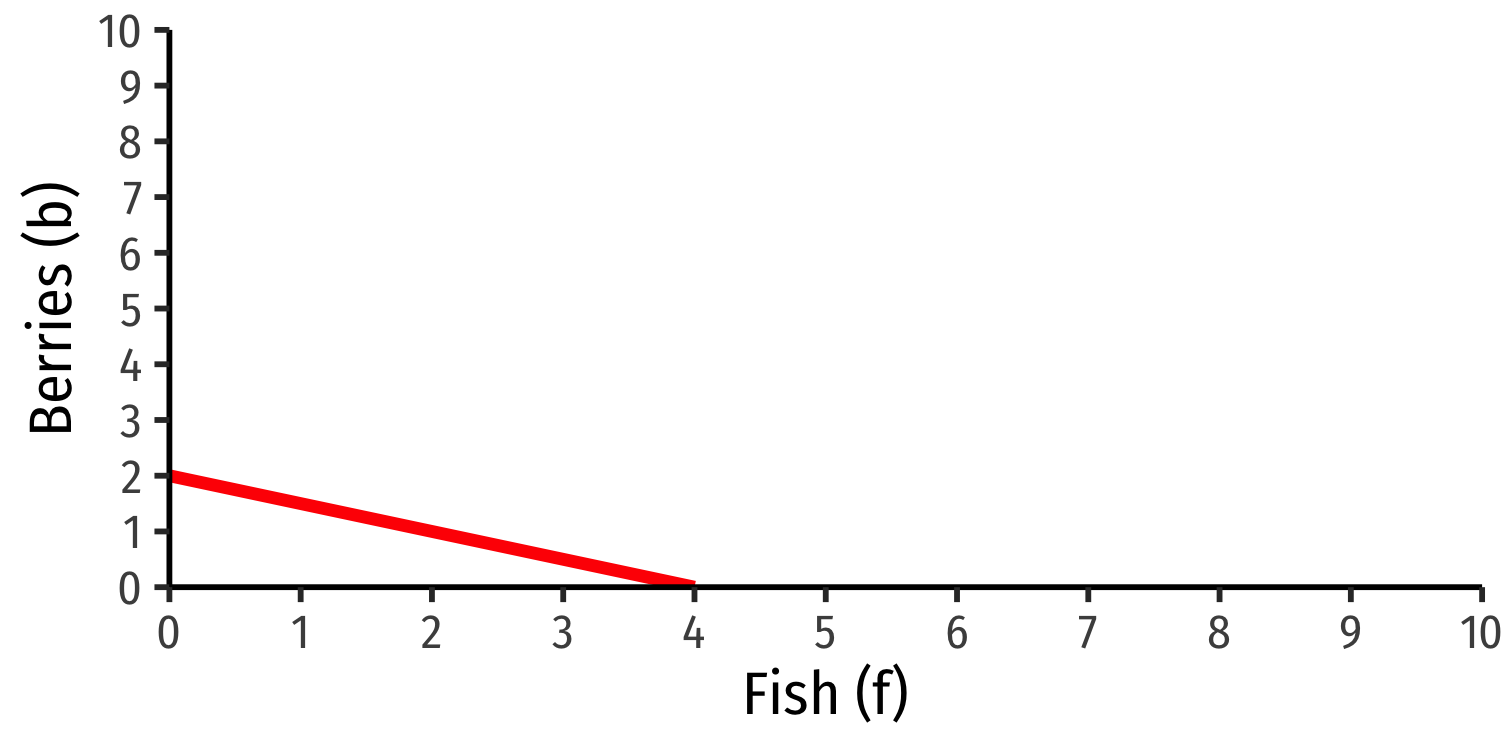

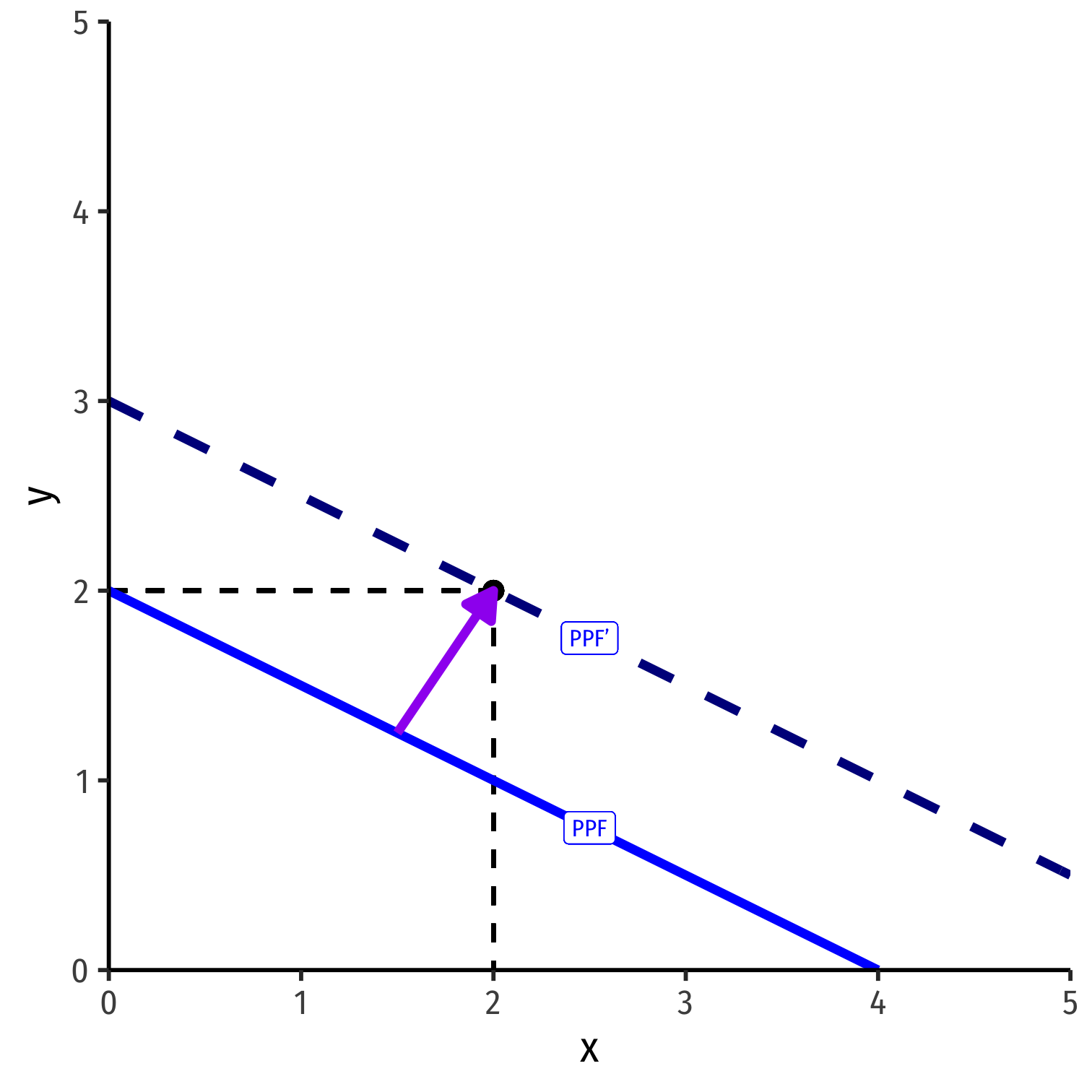

How Division of Labor Deepens Comparative Advantage

Friday’s Productivity Increase

Recall, Crusoe specialized in berry-gathering and Friday specialized in fishing

Suppose Friday becomes better at fishing (Smith’s reasons):

- Lower switching costs

- Learning by doing

- Creating specialized tools (a net)

New Opportunity Costs

Original Maximum Possible Production

| Fish | Berries | |

|---|---|---|

| Crusoe | 5 | 10 |

| Friday | 4 | 2 |

| TOTAL | 9 | 12 |

New Opportunity Costs

Original Maximum Possible Production

| Fish | Berries | |

|---|---|---|

| Crusoe | 5 | 10 |

| Friday | 4 | 2 |

| TOTAL | 9 | 12 |

New Maximum Possible Production

| Fish | Berries | |

|---|---|---|

| Crusoe | 5 | 10 |

| Friday | 8 | 2 |

| TOTAL | 13 | 12 |

New Opportunity Costs

Original Maximum Possible Production

| Fish | Berries | |

|---|---|---|

| Crusoe | 5 | 10 |

| Friday | 4 | 2 |

| TOTAL | 9 | 12 |

Original Opportunity Costs

| 1 Fish | 1 Berry | |

|---|---|---|

| Crusoe | 2b | 0.5f |

| Friday | 0.5b | 2f |

New Opportunity Costs

Original Maximum Possible Production

| Fish | Berries | |

|---|---|---|

| Crusoe | 5 | 10 |

| Friday | 4 | 2 |

| TOTAL | 9 | 12 |

Original Opportunity Costs

| 1 Fish | 1 Berry | |

|---|---|---|

| Crusoe | 2b | 0.5f |

| Friday | 0.5b | 2f |

New Maximum Possible Production

| Fish | Berries | |

|---|---|---|

| Crusoe | 5 | 10 |

| Friday | 8 | 2 |

| TOTAL | 13 | 12 |

New Opportunity Costs

| 1 Fish | 1 Berry | |

|---|---|---|

| Crusoe | 2b | 0.5f |

| Friday | 0.25b | 4f |

New Opportunity Costs Lead to New Prices

Original Opportunity Costs

| 1 Fish | 1 Berry | |

|---|---|---|

| Crusoe | 2b | 0.5f |

| Friday | 0.5b | 2f |

12 berry <pf<2 berries

12 fish <pb<2 fish

New Opportunity Costs Lead to New Prices

Original Opportunity Costs

| 1 Fish | 1 Berry | |

|---|---|---|

| Crusoe | 2b | 0.5f |

| Friday | 0.5b | 2f |

12 berry <pf<2 berries

12 fish <pb<2 fish

New Opportunity Costs

| 1 Fish | 1 Berry | |

|---|---|---|

| Crusoe | 2b | 0.5f |

| Friday | 0.25b | 4f |

14 berry <pf<2 berries

12 fish <pb<4 fish

New Post-Trade Consumption

Crusoe

| Fish | Berries | |

|---|---|---|

| Crusoe | 3 | 7 |

| Friday | 5 | 3 |

| TOTAL | 8 | 10 |

Friday

Keep same terms of trade (1b:1f)

Crusoe gives Friday 3 berries for 3 fish

Gains from Exchange and Productivity

Both exchange and increasing productivity here are Pareto improvements

- At least one person made better off, and nobody worse off

Friday, by becoming more productive, has more fish

- by becoming comparatively better at catching fish, becomes comparatively worse at gathering berries

Trade becomes more important

Crusoe better off too, getting more fish in exchange for his berries!

Trade as a Production Technology

Two ways to produce a car:

Trade as a Production Technology

Two ways to produce a car:

Trade as a Production Technology

Two ways to produce a car:

Trade as a Production Technology

Two ways to produce a car:

Trade as a Production Technology

Two ways to produce a car:

Trade as a Production Technology

Two ways to produce a car:

Trade as a Production Technology

Two ways to produce a car:

Trade as a Production Technology

- Trade is only a more roundabout way of producing for consumption

Trade as a Production Technology

Trade is only a more roundabout way of producing for consumption

Direct: increase own productivity & production

Trade as a Production Technology

Trade is only a more roundabout way of producing for consumption

Direct: increase own productivity & production

Indirect: specializing in production & exchanging with others

Extends division of labor & extent of the market!